Introduction

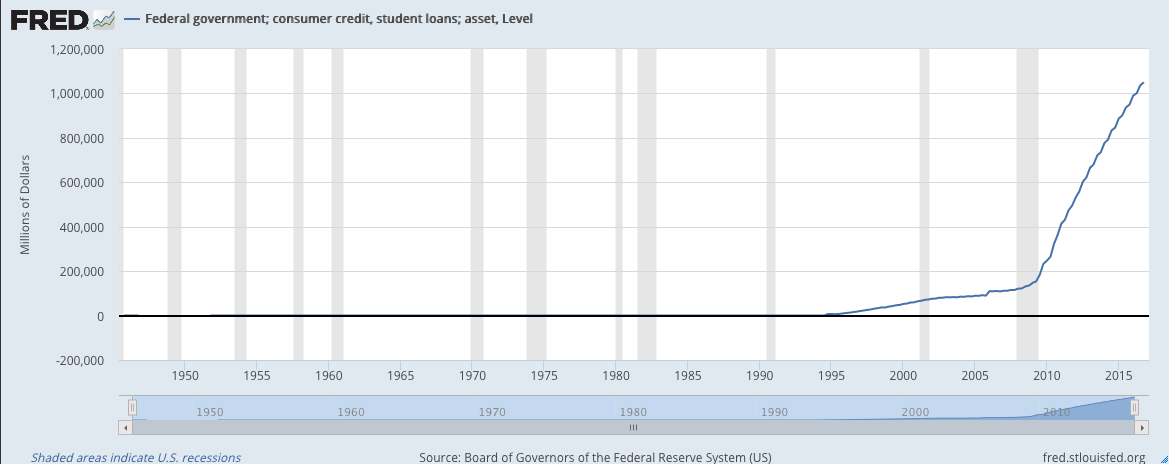

The first thing to know about your student debt is that you are not a loan. Nearly 40 million people have student debt in the United States. There is now over $1.4 trillion in student debt, up from $24 billion in 1990. That’s nearly 600% growth in a quarter century. This debt has struck low-income people the hardest.

It has made many forms of inequality worse, including racial inequality. If you can't afford to pay your debt, you should also know that you are not alone. Nearly forty percent of student debtors in repayment are either in default (they haven't paid in 270 days or more) or are past due on their payments. Millions more are in government-sponsored deferment or forbearance programs. That means that most people who owe money for education are not paying it in one way or another. One of the goals of the Debt Collective is to politicize non-payment as a collective action. In other words, millions are already on a debt strike! As we organize together, we can use our debt as leverage to make demands on the government and on the lenders who have too much power over our lives.

Know Your Loans

The first step is to make sure you know the details about your loans.

You can see all of your federal student loans on the National Student Loan Database (NSLDS) at nslds.ed.gov. Stafford (subsidized and un-subsidized), Perkins, PLUS, and HEAL as well as FFEL and Direct are all varieties of federal student loans.

Any loans you know you have that aren’t on NSLDS are probably private student loans (we will cover those later). It is also worth checking your credit report to see if you have private student loans that you may not have known about. You have a right to one free credit report a year from each major credit reporting agency (so three total) from annualcreditreport.com, but you may also have a credit card or bank account that gives you free access to your credit report more frequently. If there is a discrepancy between what your credit report says about your loans and the bills you have received, you have a right to have it corrected. (Go to the TOOLS page at debtcollective.org to dispute errors in your credit report.) Not all private loans will be on your credit report, so you may have to look through your records if you think you have a private student loan.

Some companies service federal loans and issue private loans, which can lead to confusion. Always be sure that you know which type of loan you are talking about when you dispute a debt or call a lender or collector for information.

Federal Student Loans

Different Types of Federal Loans

You would think federal student loans would come in one type. But that would be too simple for politicians so obsessed with budgets they can't create programs that broadly benefit everybody. So federal student loans come in several types. It’s helpful to know the differences.

Direct Loans are, as the name implies, issued directly by the federal government. All loans issued after 2010 are Direct Loans. Between 1994 and 2010, both Direct and FFELP loans were issued. Before 1994, all federal loans were FFELP loans.

FFELP or FFEL (Federal Family Education Loan Program) Loans are issued by private lenders—banks or finance companies—and guaranteed by the federal government. That means that if you stop paying on a FFELP loan, the issuer of the loan gives up collecting and gets a pay out from a guaranty agency for the amount of the loan you didn’t pay. Then the guaranty agency tries to collect from you. If they can’t, the federal government pays the guaranty agency the remaining amount and then the government comes after you. This ridiculous and corruption-ridden system was developed as an accounting trick to keep federal student loans off of the government’s books.

Stafford Loans are the most common form of loans. They can be FFELP or Direct Loans. Subsidized Stafford Loans do not accumulate interest while you are in school or deferment. Unsubsidized Stafford loans do accumulate interest during these periods. More details.

Perkins Loans are made directly from your school, using federal funds. They are like Subsidized Stafford Loans, with some additional benefits, including lower interest rates (others are discussed in other sections). They are only provided to students below certain income thresholds. More details.

Parent PLUS Loans are issued to parents of students to supplement other loans. Generally, parents must have good credit to be approved for a PLUS loan. There is no interest rate protection and other protections are minimal (as covered in other sections). More details.

Grad PLUS Loans are supplemental loans for grad students. Their rule are the same as for Parent PLUS loans.

Consolidation Loans are the loans you take out when you consolidate other federal loans. They operate differently depending on when they were taken out. More details.

Federal Student Loan Servicers

With federal student loans, your main point of contact is generally a servicer. Servicers are all private companies that make nearly all their money by collecting on your loans. Technically, servicers are required to help you, but they have often proven untrustworthy or even predatory. Navient, the biggest servicer, has been sued multiple times for misleading borrowers. Be cautious and do your homework on your rights before trusting what a servicer tells you. Problems with servicers should reported to the Department of Education’s Ombudsman and the CFPB.

If your federal loans are in default, somebody other than your servicer may contact you about them. This is discussed further in the section on default.

Here are the federal student loan servicers:

Getting Your Loans Cancelled

The best way to get out of paying student loans is to have them erased. Debt Collective members are in the process of building enough power to force the government to renegotiate, cancel or stop collecting on federal student loans. While we organize, only some are eligible for discharge.

There are three types of circumstances in which you can have your student loans discharged under current law: (1) if you are in an extreme situation that prevents you from paying, or (2) if your school engaged in illegal behavior, or (3) if you work in public service field (such as teaching), you may also qualify for a discharge after repaying portions of their loans. Option #3 is discussed here and here.

Extreme Circumstances

The law says that if you are “totally and permanently disabled” such that you cannot, for medical reasons, make enough money to pay your loans (if you have been medically unable to work for 5 years), you can apply to have your loans canceled. If you have already received a determination from the Social Security Administration regarding inability to work, the Department of Education is supposed to automatically receive that information and notif you to apply. But surprise! They stink. So you should submit an application if you suspect you might be eligible.

If you suffered through a major disaster like 9/11 or Hurricane Katrina, you may also be eligible to have at least some of your loans discharged. More information here and [here)[https://studentaid.ed.gov/sa/about/announcements/disaster#for-borrowers]. If you’re suffering through the ongoing disaster of a world without good jobs and ballooning debt, that’s not disaster enough for the government! Sorry!

If you are in extreme financial circumstances, you may be able to get your loans discharged through bankruptcy. This rarely happens, but it is not impossible. Generally it helps to have a lawyer since student loans in bankruptcy are a complicated legal issue. Some good initial information on consumer bankruptcy is here.

If none of that is extreme enough, how about death? If you die your federal loans are discharged. There, don’t you feel better?

School Wrongdoing

There are two ways you get can your loans discharged if your school wronged you.

False Certification If you did not have the “ability to benefit” from a school’s training, then you can have your loans discharged. If your school signed you up for loans even though you didn't have a high school diploma or GED and had not passed a required exam, you might be eligible for this type of discharge. More details

Here is the application for discharge for false certification or ability to benefit.

Similarly, if you had a “disqualifying status”, you can have your loans discharged. You have a disqualifying status if you were going to school to train in a particular occupation and you did not meet some precondition for being in that occupation. For instance, if you were physically unable to do the job you were being trained for or if you had a criminal record and wanted to be a police officer, you had a disqualifying status. Apply for this type of loan discharge here

If a school signed you up for loans without your knowledge or consent and those loans didn’t go to you or to covering your tuition bill at the school, you can apply to have your loans discharged.

If you were a victim of identity theft, loans taken out in your name can be discharged if you apply.

Borrower Defense/DTR

Defense to Repayment (DTR) discharges are granted if a school lied to you about the benefits of earning a diploma or otherwise engaged in shady tactics to get you to enroll. For a long time, the Department of Education pretended DTR didn’t exist. But Debt Collective members engaged in a debt strike and a coordinated debt dispute campaign and forced the Department to acknowledge the law. Since this is a relatively new discharge in practice and since the standards for the DTR discharge are more flexible than for others, applying for this discharge is less clear-cut. The Department of Education knows that millions of students have been defrauded by their schools and they don’t want to cancel all of their debts. So we have to fight them. Just applying for a DTR discharge and encouraging others to do so is an important step in that fight. Filing for loan relief creates a record and shows the federal government that you’re paying attention. And if others from your school submit an application, it builds a trove of evidence in support of your individual claim.

Here is the Department of Education’s information page on borrower defense (another name for "DTR").

Here) is the online application.

If you have FFELP loans (see the section on TYPES OF LOANS), then you may have to consolidate your loans into Direct Loans before qualifying for DTR. Because DTR is in flux right now, we do not recommend consolidating just because you want to apply for DTR. If you have other reasons you’re thinking about consolidation, see the CONSOLIDATION section on this page.

Closed School

If your school closed while you were attending or you before you were able to complete your program (if you dropped out), you can have your loans discharged. Sometimes these discharges are done automatically, but usually you have to apply.

You cannot receive a closed school discharge if you completed a "teachout" when your school was closing. That means you should be cautious about whether to accept a teachout or not. Many schools that are closing are closing because they were not providing good educations and you may be better off just getting your loans returned to you (along with your eligibility to take out student loans) and start again than staying in debt trying to finish an education that was not as good as you thought. You can also apply for discharge if you drop out of the teachout.

Avoiding Payment

If you don’t qualify for debt cancellation under current law, then you can use other methods to avoiding payment. This section discusses several of them.

You do not have to pay anybody to apply for any of these programs on federal student loans. Somebody offering to do it for money is probably scamming you.

If you have low income, you should keep in mind that you can avoid payment by enrolling in an income-based repayment plan (IBR), which can be as little as $0/month payments and is generally a better long term option. (More details are in the REPAYMENT PLANS section.)

You can also just stop payments altogether, going delinquent and then into default. As discussed in the DELINQUENCY AND DEFAULT section, this tactic has risks and may end up with the government and its contractors taking your money anyway via garnishment or other measures.

Grace Period

After you leave school (whether by graduating or dropping out), most federal loans come with a grace period. For Stafford and PLUS loans it’s six months (but for PLUS loans you have to ask). For Perkins, it's nine months. More details here.

Deferment

Deferments are a temporary stop to loan payments—if they are subsidized loans like Subsidized Stafford or Perkins, they do so without accruing interest. You can get a deferment on your loans if you’re in some circumstance that makes it especially hard to pay your loans (apart from, you know, the general catastrophe of the job market). You are only eligible for deferment if your loans aren’t in default.

There are several circumstances in which you can get your loans deferred and, if you qualify, you can use one after the other to prevent payment for a long time, up to a few years.

While you are in school, in a graduate fellowship, or a rehabilitation training program, you can defer your loans (this also includes if you’re on active duty in the middle of your studies). This may happen automatically, but you should contact your loan servicer to make sure they do it.

As well, while you are on active duty in the military, you can defer your loans by applying here

If you are unemployed, you can get an unemployment deferment. Unemployment deferment lasts for six months, but you can renew for up to three years. You can apply either by submitting proof that you are receiving unemployment benefits or that you are not employed but actively seeking employment.

Whether employed or not, you can apply for an economic hardship deferment. Calculate your eligibility here. Apply for this form of deferment here.

Perkins loans have additional forbearance options. More details.

Forbearance

Forbearance is a way to stop repayment while interest continues to accrue on your loans. It is easier to get forbearance than deferment. You may even be able to claim forbearance—or at least get a stop on collections—when your loans are in default. The Department of Education does not like this interpretation of the law, but it’s worth applying for because it’s a legitimate interpretation and it could be the difference between garnishment and keeping your wages. If you are denied you can reach out to us and we may be able to help you contest the decision.

Forbearance comes in three types: mandatory, discretionary, and administrative. Requesting it requires contacting your servicer.

Discretionary forbearance is theoretically unlimited, but it requires convincing your servicer that you deserve it. Yikes. You can practice your approach with other debtors here on the Debt Collective site. They’re supposed to grant you forbearance if you’re having health or other personal problems that make repayment even harder than usual. Also, if you’re facing extreme financial difficulties, you may be able to convince them to grant you this type of forbearance. You can get up to a year in forbearance at a time, but you can keep renewing if they’ll let you. Don’t forget that interest accrues.

Mandatory forbearance is limited, but servicers can’t deny you if you meet the criteria (which includes things like being in a residency program and working for the park service or the National Guard). You can get up to a year at a time, but you eventually max out (at what point depends on the reason). More details.

Administrative forbearance is available when your servicer is processing some other request. For instance, if you submit a Defense to Repayment application, you should get a year of administrative forbearance, renewable until the application is resolved. Another good reason to try to get your debt canceled! See the section on GETTING YOUR LOANS CANCELLED.

Repayment Plans

If you don’t make a lot of money, you can reduce your student loan repayments on one or another of the of “income-driven” repayment plans (yes, there is more than one type). Low-income folks can even end up paying $0 per month (with interest accruing) on income-based repayment plans. That’s effectively the same as indefinite forbearance. If you work in teaching or another public interest job, you can also get some relief on your payments.

Budget-obsessed policymakers have made the process of picking repayment plans ridiculously complex to pinch pennies wherever possible.

We don’t go through all the options here. Your servicer is supposed to help, but they suck. The Dept. of Ed. has a calculator that can help you determine which payment plan might work best for you.

Consolidation/Refinancing

Consolidation means taking out a new federal student loan (a “consolidation loan”) and using it to pay off your existing federal student loans. Doing so turns multiple loans into one loan, may change the interest rate, and converts other forms of federal student loans (FFELP, Perkins, e.g.) into Direct Consolidation Loans.

Consolidating loans can be useful if you have more than one federal student loan, if your loans have variable interest rates, if you’re in default on your loans, or if you want to apply for Defense to Repayment but you only have FFELP loans.

The interest rate on a consolidation loan depends on the loans you already have. It will not necessarily be lower than your current interest rates. It is the weighted average of the interest rates on the loans being consolidated. That means that the interest rates on the biggest loans you have (i.e. the loans with the highest principal) count for the most. Interest rates on consolidation loans are fixed, unlike some older student loans, which vary. Your servicer can help you determine what your interest rate will be on a consolidation loan.

Before going any further, remember: do not pay anybody to consolidated federal loans for you. It is free and easy to do so yourself.

Generally, you can only consolidate your loans once. There are some exceptions:

If you have an eligible loan that was not included in the first consolidation and you include that loan in the new consolidation. The eligible loan could be a new loan you received after the initial consolidation loan. It could also be another consolidation loan.

If you previously consolidated into a FFELP loan and are in default, you may be able to consolidated to take advantage of income-driven repayment.

You can “re-consolidate” if necessary to participate in the Direct Loan public service loan forgiveness program. See more here: https://studentaid.ed.gov/sa/sites/default/files/public-service-loan-forgiveness.pdf

If you are in the military, you are likely allowed to re-consolidate.

To consolidate, go to this website

In addition to consolidation—which is a federal program—some private lenders (e.g. SoFi, Earnest) also offer to refinance federal student loans at different interest rates. These private lenders mostly benefit people who have good credit scores, since private lenders only offer low interest rates to people with good credit. Even if you might benefit from a private refinancing in terms of interest rates, you should hesitate before doing so. Private student loans do not come with the same rights as federal student loans (see the section on PRIVATE STUDENT LOANS). Once you refinance to a private student loan, you cannot change them back: no private student loans can be consolidated in a federal student loan.

We repeat: you cannot consolidate private student loans into federal student loans.

Delinquency/default

When you’ve stopped paying your loans without taking advantage of one of the legal ways to avoid repayment, you are said to be "delinquent" on your loans. When you are delinquent for 270 days or more, you are in default.

If you’re delinquent or in default, remember that you are not alone. Sixteen percent of student loan borrowers are in default and nearly 1 out of every 5 student debtors are delinquent. Indeed, 45% of student loan borrowers are not in repayment through some means or another.

This is a systemic problem. While you should of course do what you can to protect yourself from the consequences, you should not feel bad about being in default. Elected officials and lenders should feel bad about creating an education system that forces people into unpayable debts. If they see that people aren’t paying, more of them will be forced to realize that the system doesn’t work.

When your loan goes delinquent, your servicer is required to notify you and explain your rights and your options to get back into good standing with bloodsucker lenders. These appeals will intensify the closer you get to default. Until you are in default, though, the servicer can't do anything more than ding your credit report.

When your loan goes into default, you are in collections. Technically, your entire loan amount comes due. This is when servicers and collectors can really start to go after you. But you can fight to stop them and you can get out of default. Depending on your situation, the consequences may not be so bad.

If you have FFELP loans (you would only have these loans if you took out loans before 2010, and not necessarily even then), your loans will transfer from a servicer to a guaranty agency (more on how FFELP works here). Here is a list of guaranty agencies. Probably you'll be dealing most directly with a collection agency hired by a guaranty agency of the Dept of Ed to go after you. They're supposed to work with you, but you will likely have to fight with them.

For all federal loans, default allows the holder of the loan (whether a guaranty agency, the Department of Education through a servicer, or the US Treasury) to take your money without your giving it to them. They don’t have to take you to court to garnish your wages, take away (“offset”) your tax return, or even prevent you from getting government benefits (also called an “offset”). But they are supposed to notify you before they do so.

Contrary to rumors, they cannot arrest you or put you in jail for not paying a loan. You have not broken any criminal laws.

What’s that you say? The fact that you don’t have enough money to repay your loans is also the reason you need wages, tax returns, and government benefits? Hm, maybe the student loan system wasn’t actually designed to help you.

If collectors are feeling really vindictive and you’ve been in default for a long time, they may try to sue you to try to seize your car or some other asset. This is rare, but not impossible. If you are being sued, you should hire a lawyer or contact legal aid in your area. Visit the FORUMS at debtcollective.org to discuss your options with other members.

You can and should contest these forms of coercive collection. We can do it together. See our TOOLS page at debtcollective.org for some options.

There are also ways to get your loan out of default. Doing so requires that you make some payments to show that you’ll be an obedient little debtor, but you may eventually be able to avoid payments by using IBR, deferment, forbearance, or one of the other means discussed above. The two main ways to do this are rehabilitation and consolidation. This is a helpful guide on their pros and cons.

Watch out for Scams

For federal loans, you should never have to pay to consolidate, apply for a discharge, go into forbearance, or, really, anything else having to do with federal loans. Anybody who offers to help with any of these things for a fee (unless they are a lawyer helping you with a complicated issue) is scamming you. They might not even be able to help you at all. Be especially careful if they pretend to be agents of the government who attempt to charge you a fee: such companies go in and out of business quickly and exist only to take your money.

Private Student Loans

Private student loans are a clear indicator of how ridiculous our society has become. It's bad enough that our state and federal governments have stopped funding higher education such that we have to fill the gap with subsidized federal student loans. Now tuition has gotten so outrageous that some of us have to take out private student loans just to get an education that should be our right.

Basics on Private Student Loans

You may have a private student loan from a bank, another financial institution, or even from your school. Perhaps you also used a credit card or a line of credit to pay for tuition or expenses during school, but this does not count as a “private student loan” for regulatory purposes. Stay tuned for other Debt Collective guides for help with those loans.

Federal student loans have (relatively) clear rules and borrowers have (relatively) clear rights. Private student loans, not so much.

Each private loan is governed by a contract, also called a promissory note. Lenders are legally supposed to follow the terms in that contract. If they don’t, you might have grounds for a breach of contract lawsuit. So it’s helpful to have a copy of your promissory note. If you think your lender may have violated the terms in it, you should talk to a lawyer. Resources for finding an attorney are here. You can also ask folks in the FORUM for help getting legal advice in your area.

Each private student lender also has its own policies for how it deals with loans. Since these policies are not dictated by Congress or by the Department of Education (who rely somewhat on student debtors to remain in office), they tend to be even less debtor-friendly than those written for federal student loans. What’s more, whatever your lender's policy is, it ultimately just wants to make money off of you. This can obviously work to your disadvantage, but it can also work to your advantage if you can convince a student lender that, say, reducing your principal will make it easier for them to get any money from you at all (since you can't afford to pay the higher amount).

Private student lenders, servicers, and collectors are regulated. Each state has its own set of debtor’s rights, and federal law has additional debtor protections (it also dictates bankruptcy law) and some states are better than others. The Consumer Financial Protection Bureau (CFPB) is the main federal regulator you should know about. Its student loan complaint form is here.

Make Them Prove What You Owe

There are a lot of shady dealings that go on in the private student loan world. Loans are bought and sold, and sometimes even “securitized” (i.e. sold in pieces to investors) often without debtors ever knowing about it. This “secondary market” is sort of like a game of hot potato: pass a loan along, try to collect from somebody, and then pass it along again until the last collector is stuck with a piece of paper that nobody is paying on.

As debts are passed along, often documentation gets lost. Without proper documentation, a collector is not allowed to collect the debt—they might not even legally own it. That means whoever is trying to collect from you might not actually have the right to do so.

You should insist on seeing loan documentation, including the original loan contract/promissory note and “chain of assignment” if the private debt has been sold. It is also good to have this information to know what your rights under the loan contract are. Here is some good information on what to look for in chain of assignment: http://caveatemptorblog.com/7105/evidence-of-assignment/.

If there is a discrepancy in the chain of assignment (a collector can't prove the debt was legally bought from the original lender or from another collector) and a lender or collector is still trying to collect, you should complain to the CFPB and consider seeking legal representation.

You should also use the general debt dispute on the Debt Collective's TOOLS page. If they are dinging your credit report, you should contest it with the credit reporting agency with our tool on the TOOLS page.

For more information on how to deal with debt collectors, see the DEBT COLLECTORS page.

Getting Private Loans Cancelled

Although private student loans do not have the same process for loan cancellation as federal student loans, you still have rights. If your school lied to you about your education or its cost, the amount you would owe, the services the school offered, or anything else that affected your decision to go to school and/or to take out loans to pay for it, you might have legal grounds to get out of paying your loans. That might also be true if your lender tacked on hidden fees or failed to comply with the terms of the loan agreement.

Unlike with federal loans, you cannot fill out a form and submit it to the Department of Education to get your loans canceled (this doesn't always work with the Dept of Ed, either). You can dispute the loan with credit reporting agencies on our TOOLS page. If you’re dealing with a debt collector, see our page on DEBT COLLECTORS. Complaining to the CFPB is another step you can take to try to get the government to get the collector off your back. http://www.consumerfinance.gov/complaint/#student-loan

Beyond that, you have to either sue the lender/collector or wait for the lender to sue you (and then defend against it) to get a court to force them to stop collecting.

Waiting to be sued on debt is obviously risky: they can keep dinging your credit until they sue (which you can challenge!) and then once they sue you risk losing. Maybe they won’t even tell you they’re suing—which is illegal but not uncommon. Obviously this is easier with a lawyer.

Suing them makes getting a lawyer even more crucial. If you can't find a lawyer, you can ask folks in the FORUMS how to proceed on your own.

Even if you can’t get a lawyer, know that lenders/collectors generally would prefer not to deal with a lawsuit. It’s expensive for them, and the longer it drags out the less money they make from collecting on you. They might make a deal with you so that you can pay a reduced amount and get clear of the debt. In other words, inability to pay plus your threat of legal action can be a bargaining chip if you’re ready to deal with the potential consequences of a lawsuit (see the next section).

Tips on Avoiding Payment

Unlike federal loans, there is no formal delinquency/default sequence for private loans. If you stop paying, you’re likely in default (depending on the terms of your loan contract), and the lender/collector can ding your credit or escalate to suing you. They’ll contact you a lot, too.

Some lenders of some loans will offer forbearance if you ask—it can’t hurt to find out. Usually they will charge a fee for forbearance and interest will accrue.

Lenders might also be willing to negotiate lower payments or reduction of the principal balance, although we have heard that often they are hardasses. They know that if they give in to somebody, others might follow. How much you can get depends on how hard you bargain.

What bargaining power do you have?

- If the loan is illegal or legally questionable, you have a threat to sue (even if you won’t actually sue), so you could hold that over them.

- If you make them realize that you really can’t or won’t pay and that you’ll show up in court if they sue you (even if you don’t have a lawyer), they might realize that they’re better off accepting a deal than having to deal with the costs of going after you. Remember, it's a pain in the ass for them to collect on debt and the more of a pain you make it, the less they will want to keep doing it.

- If you haven’t paid on a loan in a long time, you might have an advantage. Each state has a statute of limitations on loans, meaning that you have a defense to paying the loan if you haven’t paid for a long enough time (how long depends on the state law governing the loan). If you’re near or past the statute of limitations you might be able to get away with not paying and then defend against it in court. If you’d rather not go to court, then you can use this as a bargaining chip to get a much lower payment amount or to try to convince them to stop collecting.

If you outright refuse to give these bloodsuckers any money, then you should do everything you can to make collecting on you as difficult as possible. They might just give up.

- Make them give you documents.

- Make them do it again.

- Challenge the loan with credit reporting agencies.

- Show up to court if they sue you.

- Argue with them.

- Sue them (even if you don't think you'll win). Better yet, get a lawyer to help.

- Complain to the CFPB.

- Complain to the FTC and any other regulator or elected official you can get to listen to you.

If they win in court and begin garnishing your wages or bank account, get a job that pays in cash or drop your bank account. For more see chapter eleven in the Debt Resisters' Operations Manual: http://strikedebt.org/drom/chapter-eleven/

Being Threatened and/or Harassed?

You and your family have rights not to be threatened and/or harassed by debt collectors. Tell them to stop—they are required to stop if you tell them to. You might also be able to sue them if they’ve violated your rights not to be harassed. See the page on DEBT COLLECTORS for more.