Why are we all in debt?

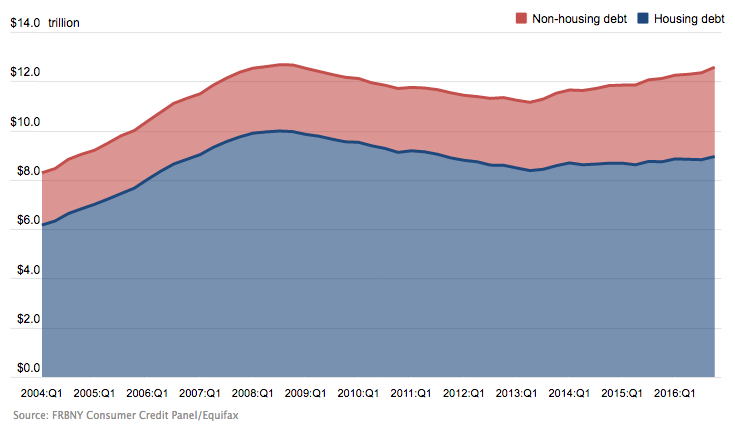

You’re in debt, but you are not a loan. 70% of the adult population holds debt. There is over $12.5 trillion in household debt outstanding in the United States. There are more credit card debts (~450 million) than people (~320 million). No other country in the world has such an indebted population. Surely this can’t be all of our faults individually. There has to be a systemic problem.

Moralists tell us we’re in debt because our “culture” makes us “irresponsible”, as if we’re all living in the lap of luxury. But who benefits from our having so much debt?

Remember, your debt is somebody else’s money. Most of our debts are owed the big banks like Wells Fargo, JP Morgan Chase, and Goldman Sachs that crashed the economy and got away with it. And how did they crash the economy? By pushing mortgage debt on us: telling us it was a sure thing.

The fact of the matter is this: the basics of life—healthcare, housing, education, and the like—have become more expensive. But it has become harder and harder to find work that pays. The rich have gotten richer by cutting our salaries (and breaking the unions that helped us negotiate higher salaries) and then they can get richer still by lending us the money to pay for the things we can no longer afford.

In dollar amounts, most debt is housing debt:

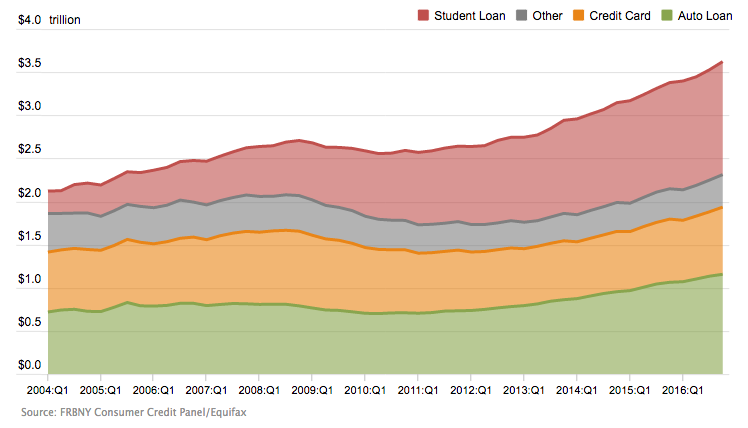

Student loans are the second biggest source of debt, then auto loans, then credit cards:

And people who have credit card debt are much more likely to be unemployed or underemployed, to lack health insurance, to have kids (who are expensive to raise!), or have recently been in a divorce.

In other words, most debt goes to pay for the essentials of life. That’s not a cultural problem. That’s a problem with providing basic needs.

And if big banks can make money off of our economic struggles, well, then, that’s a wealth hoarding problem. It’s high time for debtors to join together and demand that rich people stop stealing from us.

Don’t Forget: Creditors are in it for the Money

What separates a loan from other ways of giving somebody money is that the person (or company) that gives a loan expects it to be paid back, usually with enough interest to make some money on it. If a creditor didn’t expect to be paid back, they wouldn’t be giving a loan—it would be a gift or a salary or something else.

And creditors only really go into the business of lending if they think it will make them more money than they lend out (a profit). Although creditors commonly advertise themselves as wanting to help, most of them really only care about you if they think you might make them some money.

It’s important to keep this in mind when you’re dealing with creditors. Usually they’re only going to offer you something if it benefits them. No matter how good they make something sound, make sure to be skeptical and ask yourself “how might this might be making them money? And does it actually benefit me?”

Underwriting: How Creditors Choose Whether to Lend and on What Terms

To protect their bottom line, creditors sort between potential debtors on the basis of how likely they think debtors will be able to repay. This is called underwriting. For most loans nowadays, this is done by using credit scores. (For more, see the section on CREDIT REPORTS). With bigger loans, like mortgages and auto loans, lenders generally also look at your assets and your debt-to-income ratio.

You can imagine whom the underwriting process benefits: people who already have wealth and higher incomes. They are more likely to get loans and to get them at lower interest rates.

Sometimes lenders also use discrimination—by race, gender, marital status, or something else—in making lending decisions. Obviously they don’t announce that they’re doing it. It is illegal. If you suspect that you have been discriminated against, let us know in the FORUMS.

The Contract/Promissory Note: Proof of a Debt

Any loan that is legally enforceable is also a contract. That means it comes with terms and conditions: how quickly the loan is supposed to be repaid, at what interest rate, with which fees, what happens if you don’t pay, etc. These are generally written out in documents called “promissory notes”, but for some, like credit cards, they are called "agreements". These contracts are used in court to prove the existence of a loan and to enforce the terms of a loan.

You should have signed some sort of contract/note with a creditor in order to take out a loan. If you didn’t, the loan may not be enforceable.

It is important to get a copy of the contract/note that goes with your loan from whoever is trying to collect on it. Without it, you have to rely on them for information about the terms of that loan. Plus, if whoever is trying to collect your loan (whether the original lender or a debt collector) does not have the contract/note, then they will be unable to prove that you owe them money in a court of law when you demand evidence. So you could get them off your back.

One important thing to look out for in contracts/notes is an “arbitration clause.” This is a clause that says you can’t sue a creditor in court or as part of a class action if they’ve done something wrong. You can only sue them in a private court called an “arbitration tribunal” that is very creditor-friendly. These clauses are now very common, and generally they are legal. You should generally try to avoid them if you can.

With credit card debt and other forms of “revolving loans”, the terms and conditions of you loan can change periodically without your knowledge.

Secured vs. unsecured debt

An unsecured loan is simple: a lender gives a borrower money in exchange for a comittment to repay that money with interest. A secured loan is like an unsecured loan plus a "security": a borrower's pledge to give the lender one of their assets if they fail to pay. (Securities are also sometimes called "collateral").

The most common secured loans are home mortgages and car loans--if you don't pay you lose your house or your car. But you can also secure loans with other collateral: rent-to-own stores, for instance, will take the furniture you rent from them if you stop paying.

Unsecured loans are every other loan: student loans, credit card loans, bank loans, payday loans, etc.

Principal, Interest, and Fees: Understanding Your Bill

The cost of paying a loan can be broken into three parts: principal, interest, and fees.

The principal is the amount that you originally took out—it’s the part that you’re paying back. Usually you pay it back in pieces.

Interest is the amount the creditor charges you to borrow from them. Interest is not a fixed amount—it’s little bit you pay with each payment. Generally interest is not priced as a fixed dollar amount, but rather as a percentage of the remaining principal: an interest rate. Interest rates are generally measured on an annual basis as “annual percentage rates” or “APRs”. So if you pay your loan on a monthly basis, you will pay 1/12 of the APR each month. That means longer it takes you to pay (and the less you pay with each payment), the more interest you pay over time.

A fee is an amount the lender charges for doing something other than simply issuing the loan. Penalty fees can be charged for paying a loan late, for instance, or a fee might be charged for consolidating a loan. Because creditors like to hide costs by calling them fees rather than interest, it can be hard to tell the difference between interest and fees. Some creditors charge “origination fees” or “underwriting fees”—in other words, they charge you for doing things that they always do and should be included in the interest rate. DON’T IGNORE FEES! Creditors try to hide them, but they can add up quickly!

So your monthly bill is the piece of the principle your promissory note says you have to pay each pay period (usually monthly) plus 1/12 of the APR plus any fees the lender is charging you.

For example, suppose you take out a loan for $12,000, that has a 5% APR, a $10 origination fee, and $100 late fee.

On a one-year repayment plan, you would pay:

- $1,000 in principal each month

- $10 origination fee

- Amount of interest reduces each month as the principal reduces

- Month 1: $50 (5% divided by 12) on $12,000 principal

- Month 2: $45.83 (5% divided by 12) on $11,000 principal

- Etc.

- After 12 months total payment will be $12,335.

If you only paid interest:

- $50 payment each month (principal doesn’t change, so interest doesn’t change)

- $10 origination fee

- At the end of 12 months, you will have paid $610 and still owe $12,000

If you don't pay at all:

- After one month

- $100 late fee

- $50 unpaid interest

- $12,000 principal

- $10 origination fee

- Total: $12,160

- After two months

- Another $100 late fee, total $200 in late fees

- Still $10 origination fee

- Another $50 interest, total of $100.

- Total: $12,310

Some loans actually incorporate unpaid interest into the principal amount (they call this "capitalizing" interest) and then the amount you owe in principal can grow over time. That means if you pay a small amount—too small to cover interest—then you can end up having a bigger principal than you started with even though you have been paying.

Suppose you have the same $12,000 loan and don’t pay for the first month. If the creditor capitalized the interest, you will now owe $12,050 in principal. Your next monthly bill will still charge $1,000 in principal. Your interest payment will be $50.20. The longer you go without paying, the higher your principal will go, which will also make your interest go higher. You can see how this could get out of hand.

You can see why a creditor might be happy for you to pay small amounts each month—then they can add more and more to the amount you owe them and keep you in debt to them for a long time.

Collections: Stand Up for Yourself

If you pay your loans every month, usually creditors stay off your back. Well, they might bug you to try to get you to take out more loans.

But once you fall behind, creditors can get downright nasty. And it’s not always creditors that come after you for loans. Sometimes they hire a collector or sell off the loan to one.

Collections departments and collectors thrive on fear. They want to intimidate you into paying more than you might have to. They can do this most easily if you don’t know your rights, because then you’re most likely to cave in to their demands. If you know how to stand up for yourself, you have an advantage, and might even be able to get out of paying a debt.

There are more details in the DEBT COLLECTORS section.

When S**t Hits the Fan: Default and Bankruptcy

If your debt becomes too much, you have options. You can challenge it--in court and out. That's what we're here for: we'll challenge it with you!

You can also declare bankruptcy, which stops collectors from coming after you temporarily and can result in a total discharge of all your debts (with some exceptions).

Regulation: State and Federal

Although it sometimes seems like creditors can do whatever they want, we debtors still have some rights. The rights we do have previous debtors and debtors’ advocates fought long and hard for. But creditors have been fighting back and eroding them.

Several federal laws provide debtors anywhere in America a minimum set of rights. For instance:

- The Equal Credit Opportunity Act (ECOA) prohibits discrimination in consumer lending by race or gender or other protected classes. It does not prohibit discriminating against poor people though. That always seems to be legal.

- The Truth in Lending Act (TILA) is a big bill that requires lenders to disclose certain facts about loans, creates a standard way to calculate interest rates, and regulates other aspects of the lending system.

- The Federal Trade Commission Act (FTCA) contains a provision prohibiting “unfair and deceptive acts and practices” (commonly called “UDAP” or “consumer fraud”). This is the baseline protection against creditors misleading you or engaging in other shady behavior.

- The Consumer Financial Protection Act (CFPA) added protections to the FTCA.

- The Fair Credit Reporting Act (FCRA) regulates credit reports. Check out CREDIT REPORTS for more.

- The Fair Debt Collection Practices Act (FDCPA) regulates debt collectors. Check out DEBT COLLECTORS for more.

- The Higher Education Act (HEA) regulates federal student loans. Check out STUDENT LOANS for more.

- Bankruptcy laws are also federal laws.

Depending on the state you live in, you may have additional protections in any of these areas. Most of this Know Your Rights page only deals with the baseline of rights provided by federal law, but you should know that you may have additional state-created rights.

State law also governs:

- Asset protections. Certain types of assets—such as public benefits, homes, and other important possessions—are protected from collection activities. Different states have different levels of protection.

- Evidence rules. If a creditor sues you, state law governs the requirements for what they have to prove in court. Although there is a federal baseline.

- Consumer protections. Although, as mentioned above, the FTCA provides a federal consumer protection baseline, if you want to sue a creditor, you have to use state law. Every state has a consumer protection law, but some are more protective than others.

Other sections of this guide go into these protections in some more detail. In general, though, you should know that if something seems fishy, it might be illegal.

If you think a creditor acted illegally, you have options:

- Attorney Generals (AGs). Every state has an AG, and they have consumer protection enforcement powers. They take tips and complaints from debtors in their state.

- The Consumer Financial Protection Bureau (CFPB). The CFPB is the federal agency tasked with protecting debtors. It has an online complaint/tip line: https://www.consumerfinance.gov/complaint/

- The Federal Trade Commission (FTC). The FTC was the federal agency tasked with protecting debtors (and other consumers) before the CFPB was created in 2010. It still has many debtor protecting powers and its own complaint/tip line: https://www.ftccomplaintassistant.gov/

- You can represent yourself in court. Seriously. It requires some work and research, but the basic information is on this page and you can ask your fellow debtors for help.

- You can find a lawyer. Stay tuned for a list of debtor lawyers around the country.