Introduction

In most of the United States, having a car is a necessity. You can’t get to work, school, the store, your friends’ or families’ houses, or anywhere else without one. That is because, due to lack of investment, public transportation is absolutely terrible in all but a few big cities.

But almost none of us get paid enough money to buy a car without taking on debt. That gives creditors another chance to make money off of us. There is now around as much auto loan debt as student debt (~$1.4 trillion).

Once again, lack of public investment plus low wages equals a profit opportunity for creditors.

The biggest growth in auto loan debt over the past decade has been in the “subprime” market—that is, among folks with less money who have a harder time affording a car.

As with other creditors, auto dealers/lenders will be ruthless in trying to take your money. It is important to know what they’re up to and how you can protect yourself.

The three types of car dealers

Car dealers come in three general types.

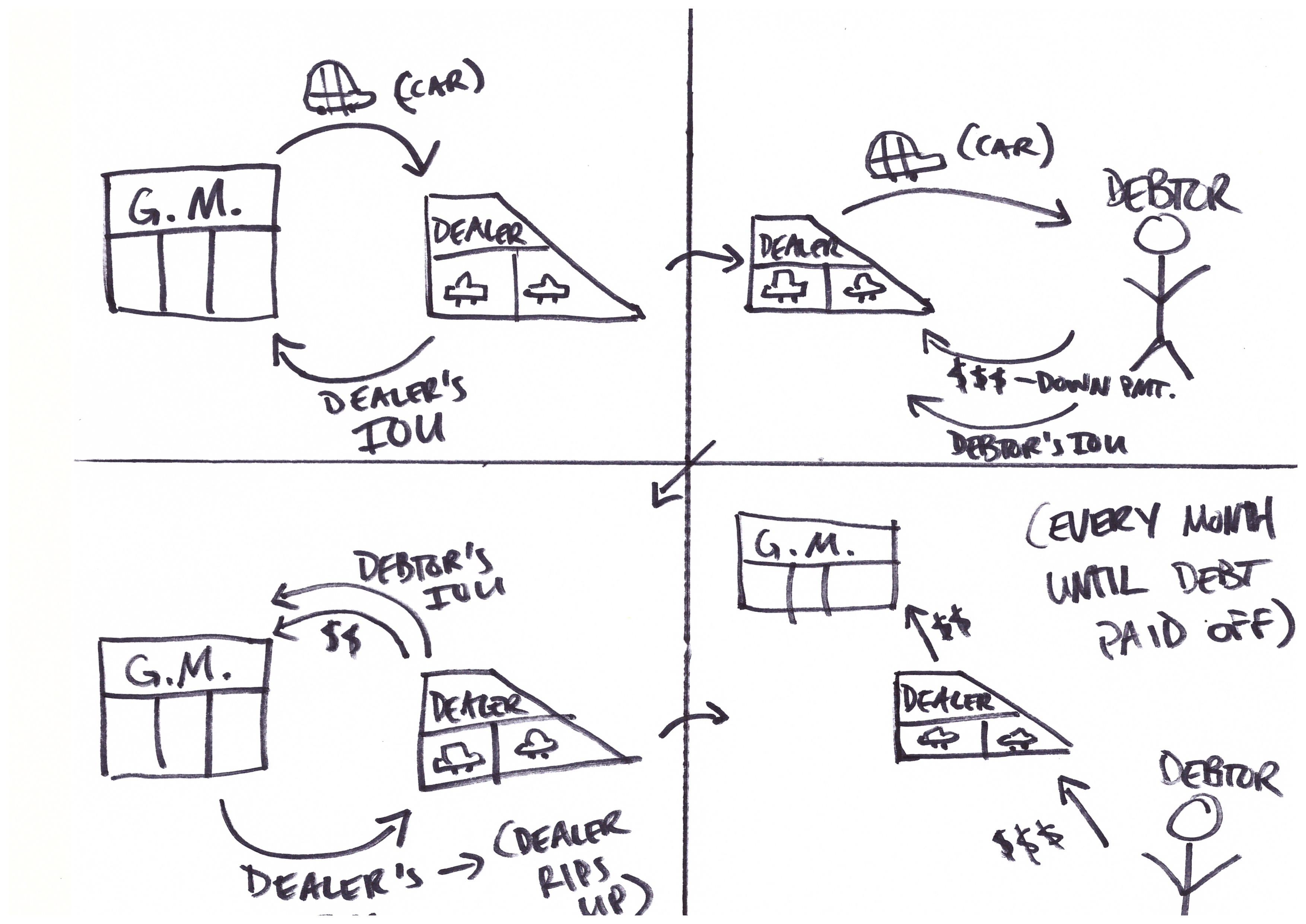

Franchise dealers sell new cars and often sell used cars as well. Each franchise dealer has signed a contract with a car manufacturer (like Ford, Honda, or Volkswagen) agreeing to exclusively sell that manufacturer’s cars. They generally borrow money from their manufacturer overlord to buy the cars the manufacturer sells them. When they offer us loans and leases to buy a car, they generally immediately resell them to the manufacturer’s financing department (did you know that car manufacturers often make more money selling loans than selling cars?). By reselling the loan they’ve bought from you, franchise dealers get the money they can then use to pay back the loan the manufacturer gave to them to buy the car they sold you. The dealer makes money by adding a markup on top of the price of the cars and loans they sell. Here’s an illustration:

Independent dealers sell only used cars and don’t offer any leases. They do not sign any exclusive agreement with manufacturers, so they can sell multiple brands of cars. Like franchise dealers, they generally borrow money to buy cars and pay back that debt when you buy a car from them. Also like franchise dealers, they generally immediately sell off any debts they’ve bought from you to their creditors—usually a bank or credit union.

Buy here pay here (BHPH) dealers only sell used cars and they only sell them to folks with bad credit. They have no exclusive agreements with manufacturers. They often keep your debts on their books, but sometimes they sell it off. Their prices are higher, their cars are lower quality (with shadier histories), and their repossession tactics are more aggressive. Many BHPH dealers are actually owned by franchise dealers or independent dealers. Those companies want to be able to sell to poor people without having them mix with their better off clientele: segregation is good for business.

How car loans and leases work

Car loans and leases operate similarly: you get a car, you have to pay a certain amount of money per month to keep the car, and if you fail to pay that amount of money the lender/lessor can take the car from you by force. But there are important legal differences between them that can translate into important practical differences.

A car loan is to buying a home with a mortgage what a car lease is to renting a home.

With a car loan, you’re buying a car but you’re borrowing money to do so. Even though the lender can take the car away from you if you don’t pay back the loan, you own the car. When you’re done paying off the loan, nobody has a claim on it.

With a car lease, you’re renting a car. The dealer owns the car. When you’re done paying off the lease, the dealer still owns the car unless you decide to pay more money to buy it.

In other words: with a lease you’re renting a car and with a loan you’re renting money to buy a car.

Car loans

Like home mortgages, car loans are usually secured debts that use a car as collateral. If you buy a car with a loan, you give the creditor a security interest/lien on the car—in other words, you give the creditor the right to take your car from you if you default on the loan.

You can get a car loan from a dealer or from a third party creditor, like a bank or a credit union. You can get one for a new car or a used car.

In order for the loan on your car to use your car as collateral, the documentation must be proper. That means that the person who owns the car (that’s you if you bought the car) should have signed a document called a “security agreement” that properly describes the car. If you took out a loan from your dealer, most often your sales contract contains a security agreement in it. If you took out a loan from another creditor, your loan documentation should have a security agreement included in there.

Car leases

A car lease you can only get from a dealer (remember, the dealer is technically lending the car to you) and for new cars only. The main advantage of a lease is that you can decide to give a car back at the end of a lease term, no questions asked. But if you’re going to buy the car after leasing it, usually doing so with a lease rather than just buying it with a loan upfront is more expensive.

Buying cars: new and used

It’s almost always a better idea to buy a used car than a new car, as long as the used car is in decent shape. Unlike houses, which generally go up in value (except when the market crashes), cars generally lose value over time. In fact, a new car loses around 10% of its value as soon as you drive it off the lot. That means you could by a totally unused “used” car for 90% of the price of the same exact car sold as new.

The main issue with used cars is making sure they aren’t so much worse for the wear that they’ll crap out on you. Some dealerships now offer “certified pre-owned” cars that have been inspected and fixed up, but you can usually find cheaper options.

There are a number of resources to help you find used cars that are likely to last longer, such as Consumer Reports. You can use Carfax to find out the usage history of any given car. And you can use Kelley Blue Book to help you figure out how much you should pay for any given used car.

No matter what kind of car you’re buying, most dealers will try to milk you for as much as they can get. Because you can pretty easily find car prices online nowadays, usually this means they’ll get you at the financing stage.

The best way to make sure you’re getting a fair deal is to use a two-part strategy: shop around and bargain hard.

Any dealership you go to will try to get you to buy something before you leave—they’ll make you feel like it would be stupid to look elsewhere. Don’t buy it. Go to multiple dealerships; look online; do your research on prices and quality. If dealers have to compete over your business, you’re likely to get a better deal.

Once you’ve shopped around for a car and are ready to buy, don’t accept the sticker price. Bargain with the dealer, and be willing to walk away if you don’t get a price you’re comfortable with. You can always bargain better if you’ve done your research on how much that type of car sells for, on what that particular car’s history is (from Carfax, e.g.), and on how much you can afford to pay a month. Use this calculator to help figure out how much car you can afford.

If you have a car you’re trading in, make sure you know its price (the Kelley Blue Book is useful).

Shopping around and bargaining for a car is only step one. Then you have to do the same for financing. As always, cost of credit will depend on your credit score. Generally a dealer will provide more expensive credit than a credit union or other lender. So it’s a good idea to go to credit unions or banks to get preapproved for a loan before you even go looking for cars. Start with a credit union or bank you already have a relationship with, but you can also shop around.

Once you’re at the car buying stage, you can also make an agreement to buy a car and then bring that contract to a lender to get them to lend you the money for it.

If you decide that it makes the most sense just to use the dealer’s financing, be ready to bargain. They will present you with interest rates as if they are done deals, but they are almost certainly inflated and the dealers will almost certainly lower them if you push them to do so. They’ll also try to sell you extras like extended warranties, alarm systems, rust protection, undercoating, paint protection, fabric protection, and window etching. These will be more expensive than doing them yourself or paying somebody else for them. Mostly they’re not necessary. Just say no. Insurance is necessary (depending on the type) but will be cheaper elsewhere. Also say no.

If they offer you a “factory-to-consumer rebate” they’re not making it up. Those are real. Check the manufacturer’s website to find out whether they’re offering you the full amount. But don’t treat is as special deal that you should give something up for: it comes with the car. Sometimes they will also offer you a “0% APR” contract and make you choose between that and the rebate. This calculator can help you figure out what’s best for your situation.

Red flags in the sales agreement

You should always read the sales agreement you’re offered, or as much of it as you can stomach. Most of it will probably be gibberish to you. But at least skim for things that look fishy and ask about them. Don’t sign a contract you don’t feel comfortable about. Some terms to look out for:

If the contract says you are accepting the car “as is”, don’t sign. That means that anything that’s wrong with the car is on you: you can’t return it or sue the dealer (unless you get an especially good lawyer) and you’ll still have to pay for it. Especially if you’re buying a used car, you should make sure you have a warranty. And all cars without “as is” in their sales agreements come with warranties.

If the contract says “subject to approval”, don’t sign. That means that the dealer is reserving the right to take the car back if they can’t find somebody to buy your loan (or in any other circumstance, but they can use that as an excuse). This technique is called a “yo-yo sale” or “spot delivery”. For more, see IF THE DEALER IS TRYING TO TAKE YOUR CAR RIGHT AFTER YOU BOUGHT IT.

If your car is not as promised

Should your car have something wrong with it after you’ve bought it and you think the dealer should have told you about it or the dealer might have even caused it, you can fight back. Likely your car has a warranty (most states and the federal government require it), which usually covers lying about or covering up the past of the car, messing with the odometer, and/or misrepresenting the make or model of the car.

If you want to get rid of the car and get your money back, you can contact the dealer informing them of the breach of warranty (you should have good documentation of it) and tell them you are going to return to car. This is called “revocation”. They should give you all of your money back as well as your trade-in car (or at least its monetary value), if you gave them one. If they don’t accept the revocation, you might have to sue them or take other action.

You could also sell the car (telling the buyer about the problem) and then sue the dealer for any money you didn’t get from the sale. Doing this requires notifying the dealer of the breach of warranty and your intention to sell the car first. Probably you should also talk to a lawyer.

If you want to keep the car, you can notify the dealer/creditor that you are not going to deduct the cost of the breach of warranty (usually this means the amount you’d pay to fix it) from the amount you pay them every month. The dealer/creditor might sue you for defaulting, but then you would have a defense in court. Doing this is easier with a lawyer and requires getting your documents together so that you can prove the breach of warranty.

No matter what you do, you should act quickly. Many statutes of limitations are as short as two years.

For more on odometer fraud check out the DOJ website or this law firm’s site on how to cope.

If the dealer is trying to take your car right after you bought it

In recent years a number of car dealers, especially BHPH dealers, have used a shady tactic called a “yo-yo sale” to screw people over. This tactic involves:

- Inserting a clause that says something like “subject to approval” in the sales agreement (see RED FLAGS IN THE SALES AGREEMENT). This clause makes the sale conditional on the dealer being able to sell off your debt. Meaning, if they can’t sell it off it’s no deal and they can take your car back.

- Dealers may or may not actually try all that hard to sell off your debt. But in any case they don’t sell it.

- They take your car from you, expecting that you won’t try to get your down payment back, and then resell the car to somebody else using the same tactic. They can “resell” the same car over and over, collecting down payment after down payment without actually getting rid of the car.

Many states have outlawed this tactic. Even in states that haven’t, usually the way dealers do it runs afoul of one or another law. But, as with many laws, it can be difficult to assert your rights without a lawyer.

So, if you can find one, the first step in dealing with a yo-yo sale is to get a lawyer.

Whether you can find a lawyer or not, you should:

Gather your documentation from the car sale. Look for the “subject to approval” clause or any clause that makes the deal depend on the dealer selling your debt. If it’s not there, the dealer will probably try to say that they didn’t sign the agreement so it doesn’t count. That’s not true. If the contract is not a conditional contract, they cannot take your car back. Tell the dealer that. If they go forward with repossession you will either have to defend yourself in court or sue them. Or you could go to the police.

Investigate if the conditions described in the document have actually occurred. Did the dealer actually try and fail to sell your debt? Ask them. If they don’t answer, get ready to make them prove it in court. Or go to the police and describe what happened.

If they repossessed your car, the dealer must comply with repossession requirements. See RESISTING REPOSSESSION.

Once they take your car (whether you’re going to fight to get it back or not), insist that they give you back your down payment and, if you had one, your trade-in. They have no right to keep them—they cancelled the contract. You might have to sue them or bring the police in to make this happen.

If you think you might default

This section talks about how to prevent default or get your loan out of defaul. The next section talks about what to do when you've defaulted and think your creditor might try to repossess your car.

Negotiating with your creditor

Whether you’ve defaulted already or merely expect to default, it’s good to start by bargaining. Creditors would generally prefer to keep you paying them rather than go through the (relatively) expensive process of repossession.

First determine what you can pay. Then contact your creditor/dealer and propose to negotiate a workout agreement. For more on bargaining tactics see DEBT COLLECTORS.

If you come to an agreement with the creditor, make sure to get it in writing before you start paying on it. And make sure you check over the writing to ensure it reflects the deal you thought you were getting. Don’t be afraid to say no to a deal if it’s not going to work for you.

It really might be better to fight or to lose this car and spend the little money you have on getting a more affordable one. There is no reason to agree to another payment schedule you can’t meet. Depending on your situation, it may make more sense to bargain over how to end the contract and get rid of the car than how to keep it going.

You might negotiate with the creditor/dealer to allow you sell the car yourself (you generally can’t do this if you’re leasing a car). Of course, if you own the car you’re allowed to sell it whenever and to whomever you want. But unless you’re sure you can get more money than you owe on the loan, it will be helpful to work out with the creditor/dealer on what terms they’re willing to consider the loan paid in full.

Even if they don’t agree to bargain over this, you still might want to sell the car on your own. It’s likely you’ll get more money than the creditor will by selling it at auction (see BELOW). And if you get offers for the car without selling it, you can use those offers as a bargaining tactic or, if it comes to it, in court when arguing about the value of the car.

One tip if you’re selling the car on your own: don’t work with brokers! They are usually scams. You can sell the car yourself, especially with the internet to help.

Finally, you might negotiate with the creditor/dealer to turn the car in without a struggle. If you do this, you should make sure to get something out of it: have them guarantee that they will not go after you for more money but will accept the car as full repayment. Or have them refund you some money, if you don’t owe that much more. Get it in writing. Don’t do this if you have defenses against repayment.

Remedying default if you have some money

If, for whatever reason, you defaulted on your loan but you find yourself with enough money to get current again, you can “cure” your default.

There is a right to cure loans in

- California

- Colorado

- Connecticut

- Iowa

- Kansas

- Maine

- Massachusetts

- Missouri

- Nebraska

- New Hampshire

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Virginia

- Washington, DC

- West Virginia

- Wisconsin

There is a right to cure leases in:

- Connecticut

- Illinois

- Indiana

- Kansas

- Maine

- New Hampshire

- New Jersey

- New York

- Rhode Island

- Washington, DC

- West Virginia

- Wisconsin

In other states, you may also have a right to cure written in your sales agreement (check!). Even without a clear right, creditors might be willing to allow you to cure.

Curing a default means paying back arrears plus penalties fees and costs. It does not mean paying back the whole loan.

Resisting repossession

Whether you have a loan or a lease, if you’ve missed a payment or two or think that you won’t be able to make payments, your creditor will be preparing to come after your car. You should prepare to fend them off.

Repossession takes two basic forms: a creditor can sue you to get the court to send police officers to take your car or a creditor can just come and take your car themselves (often called “self-help repossession”). The second option is the most common and is what you need to prepare for most urgently.

Once your car is in danger of repossession (after you’ve missed a couple payments—look at your sales agreement for the exact conditions of default), the first thing to do is to take your personal belongings out of your car. Anything in your car that you would miss if it were not returned should not stay in your car as long as you’re in it. That doesn’t mean you’re definitely going to lose your car or your things inside it: it means you’re preparing for the worst.

Resisting repossession out of court

Once you have defaulted on your loan or lease, the creditor/dealer can take your car. Some creditors/dealers now even have technology installed into their cars that allow them to remotely disable the car.

Creditors are not allowed to:

- Trespass on your property

- Use or threaten force

- Break into your house or garage

- Impersonate police officers

- Do any other otherwise illegal action

Generally, they are not allowed to “breach the peace” in order to get to the car. So you can put your or your friend’s or family’s body in their way. You should make sure to question anybody presenting themselves as a police officer, although once they show ID it would be illegal to stop them.

Creditors know that the hardest way to get to a car is through you, so they often sneak to get a car at night. That is legal. Resisting it requires parking a car in hard-to-find places (although doing too much to hide it can run afoul of the law and it’s hard to hide cars since creditors often subscribe to services that track license plates) or keeping somebody on duty at all hours. If you have a garage, keep it locked in there when you’re not using it.

One way to prevent repossession is to cover the VIN (vehicle identification number) printed on the front window of your car. Repo companies are supposed ot record and confirm the VIN before they take a vehicle, so placing an object over it (maybe a red square?) can prevent them from doing so.

It is hard to avoid the repo man. But it takes the support of your friends and family if you’re going to win. Don’t forget that even if they take the car, you can get it back in court.

Resisting repossession in court

You might be sued to have your car taken without even knowing about it. A police officer might just show up and take your car. If this happens, though, you have a right to a hearing afterwards.

You might get a notice about a hearing before they come to take your car, though.

Either way, the hearing is meant to be a place where the creditor/dealer has to prove that:

(1) you owe them money (the sales agreement is proper, etc.) AND

(2) you have defaulted on your loan (you broke the payment rules in the sales agreement).

You have the chance to prove that you had a defense against repayment of these loans even though (1) and (2) are true.

Get a lawyer if you can find one. If you can’t, it’s still worth representing yourself. Even if you don’t win, you might push them to settle with you by dragging out the case.

Force them to prove that you owe the loan. That means check over the documentation (did you sign it? Does it properly list the car as collateral?) and make them bring the salesperson that presented it to you as a witness. If the company trying to collect isn’t the original lender, go to DEBT COLLECTORS.

Assert any defenses you can think of. Did they breach any warranty in the contract or otherwise (see IF YOUR CAR IS NOT AS PROMISED)? Did they trespass when coming to get the car or breach the peace or threaten force? Did they accept payments late and then suddenly just refuse to accept anymore? All of these are the bases for defenses.

Bankruptcy as a defense

If you declare bankruptcy, you could stop repossession. But whether to do that depends on your situation and usually requires an attorney. We will have more resources on bankruptcy soon.

If your car has been repossessed

Losing your car to repossession is not the end of the fight. You can still get it back.

If your stuff was in the car, you should demand it back from the creditor/dealer. They cannot just take whatever was in the car. That is theft.

But you want your car back, not just the stuff in it.

If the creditor/dealer took your car from you improperly (if they violated the law or you weren’t actually in default or you had a defense against repayment), you can sue to get the car back. You really should get a lawyer to do this, but it’s not impossible to do on your own. We have some tips on going to court against a creditor here.

Declaring bankruptcy can also get your car back, at least in the short term. But whether to do this depends on other facts about your situation, usually in consultation with an attorney. We will have more resources on bankruptcy soon.

Another way to get it back is to pay. Many states allow for reinstatement, which just amounts to a cure, but after the car has been repossessed. Usually this has to happen quickly, within two weeks or so. States that allow reinstatement are:

- California

- Connecticut

- Illinois

- Louisiana

- Maryland

- Missouri

- New York

- Ohio

- Pennsylvania

- Rhode Island

- Washington, DC

- Wisconsin

You can also redeem your contract in any state, which requires paying the full loan amount (not just the arrears plus fees). Probably if you had money you would have paid already, but that’s just so you know in case you find a new source of money. Taking out a loan might make sense, depending on your situation.

Even if you don’t have enough money to qualify for reinstatement or redemption, you still might be able to negotiate with your creditor/dealer to get your car back for a modified payment plan. You will be in a worse bargaining position than before they took your car. Probably they will require you to pay a lump sum up front.

If you can’t get your car back, your creditor/dealer will have to sell it, usually at an auction. You might want to go to the auction to see what price it sells for or even to bid on the car yourself. Even if you don’t go, you might still have to fight about whether you have to pay even more or whether you get some money back. If they get less than you owe they can go after you for the deficiency. If they get more than you owe, they are required to pay you the surplus. You should be able to resolve these questions without a lawyer, but having a lawyer can help, especially if you need to sue for a surplus.

You can also argue that the creditor/dealer sold the car for too little money, by comparing it to Kelley Blue Book and any offers you may have received.

Special rules for active military personnel

If you are on active military duty, you have special rights as long as you were current on payments before you left. You have a right to lower interest rates and your car cannot be repossessed while you’re on duty. To find somebody who can help with this law see http://legalassistance.law.af.mil/content/locator.php.

Auto title pawns

Auto title pawn companies sell second loans on cars. They take your title as proof of the loan agreement. Sometimes they present themselves as not actually being able to take your car from you if you don’t pay, but they can as long as they have completed the transaction correctly.

Generally it is a bad idea to take out an auto title pawn loan if you can avoid it. Having two loans out on your car means that if you can’t pay either you could lose your car. It is better to pay slightly more for an unsecured loan (like a credit card, e.g.) that won’t cause you to lose something essential like a car if you don’t pay.