Introduction

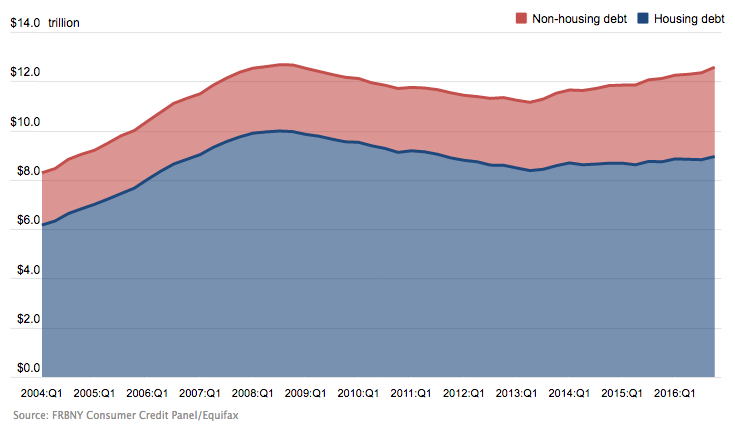

Mortgages account for most of the household debt in the United States, by far. There is $8.5 trillion in mortgage debt outstanding. That’s six times the amount of student loan debt. It’s more than twice as much as all other types of household debt combined.

Borrowing money to own a home has such an outsize role in the so-called “American Dream” that it is easy to think of mortgages as an eternal aspect of US society. But widespread mortgage debt is a modern invention—a direct result of government policy distorted by the real estate and finance lobbies. The U.S. government literally created the modern mortgage market.

Emphasizing homeownership funded through debt has had wide reaching consequences.

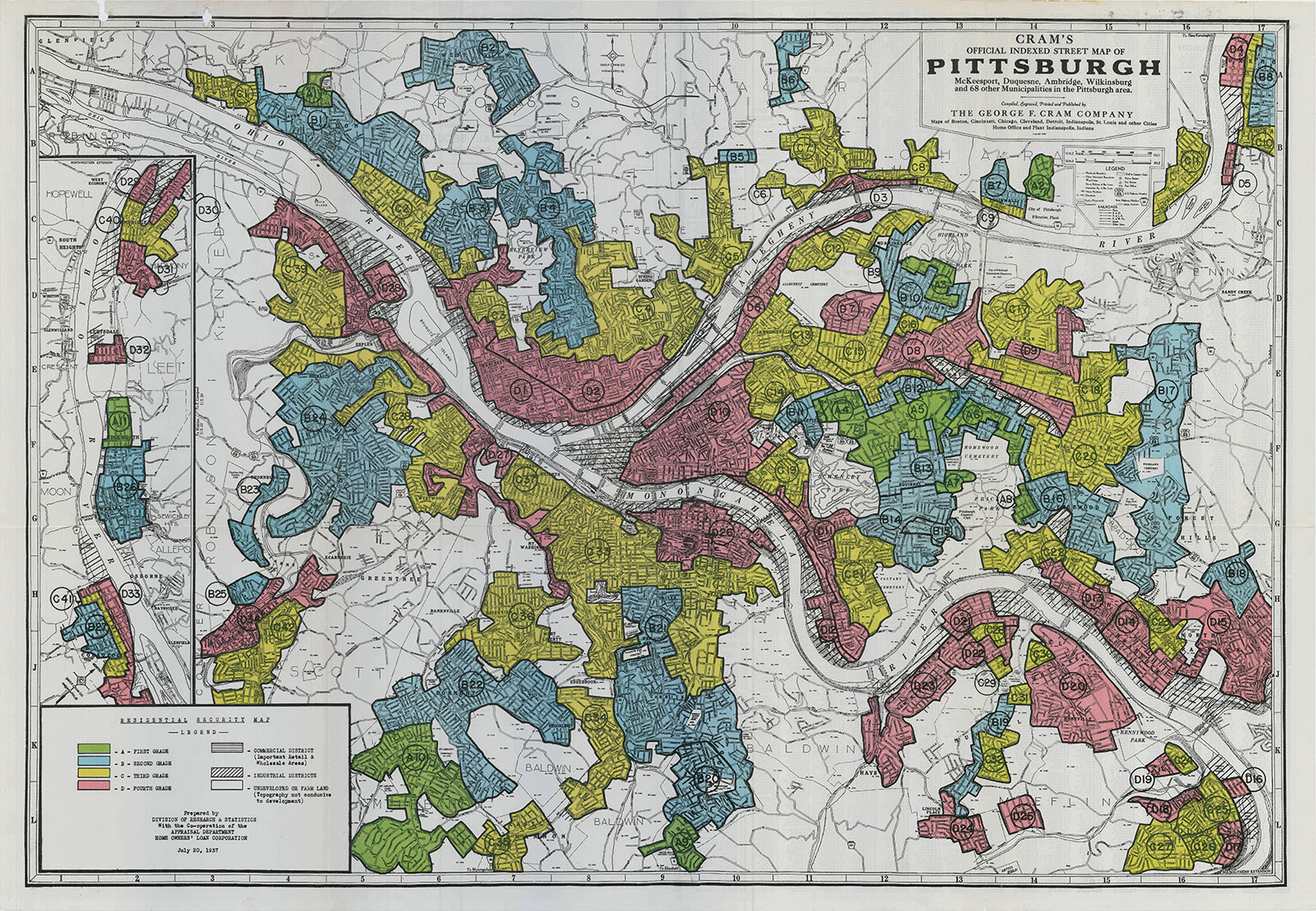

Take racial segregation, for example. Another part of the 1940s laws that created the modern mortgage market wrote racial segregation into the law. Federal guidelines basically prohibited issuing mortgage loans to predominantly Black areas (this is called “redlining” because these neighborhoods were literally colored in red on government-issued maps). Here’s an example from Pittsburgh:

As well, by making getting a home depend on tapping the private wealth of for-profit creditors rather than public wealth, we turned over a huge amount of power to Wall Street to determine who get access to shelter and on what terms. Aside from how much this has reinforced inequality, it has created instability. The housing market is one the largest sectors of the economy, so it's a place for a lot of speculation and shenanigans that can and have caused financial crises. Banks fight against the regulations that prevent crises from happening, because they make more money without them. As a result, there was a mortgage bubble that popped in the late 1980s (called the “Savings and Loan Crisis”). But apparently nobody learned any lessons. Because, as you might remember, a mortgage bubble crashed the global economy in 2007.

The banks that caused these crashes are always back in business and making huge profits. The rest of us are left to deal with the impact of their speculation. Indeed, millions of us remain in default on our mortgages

Mortgage Basics

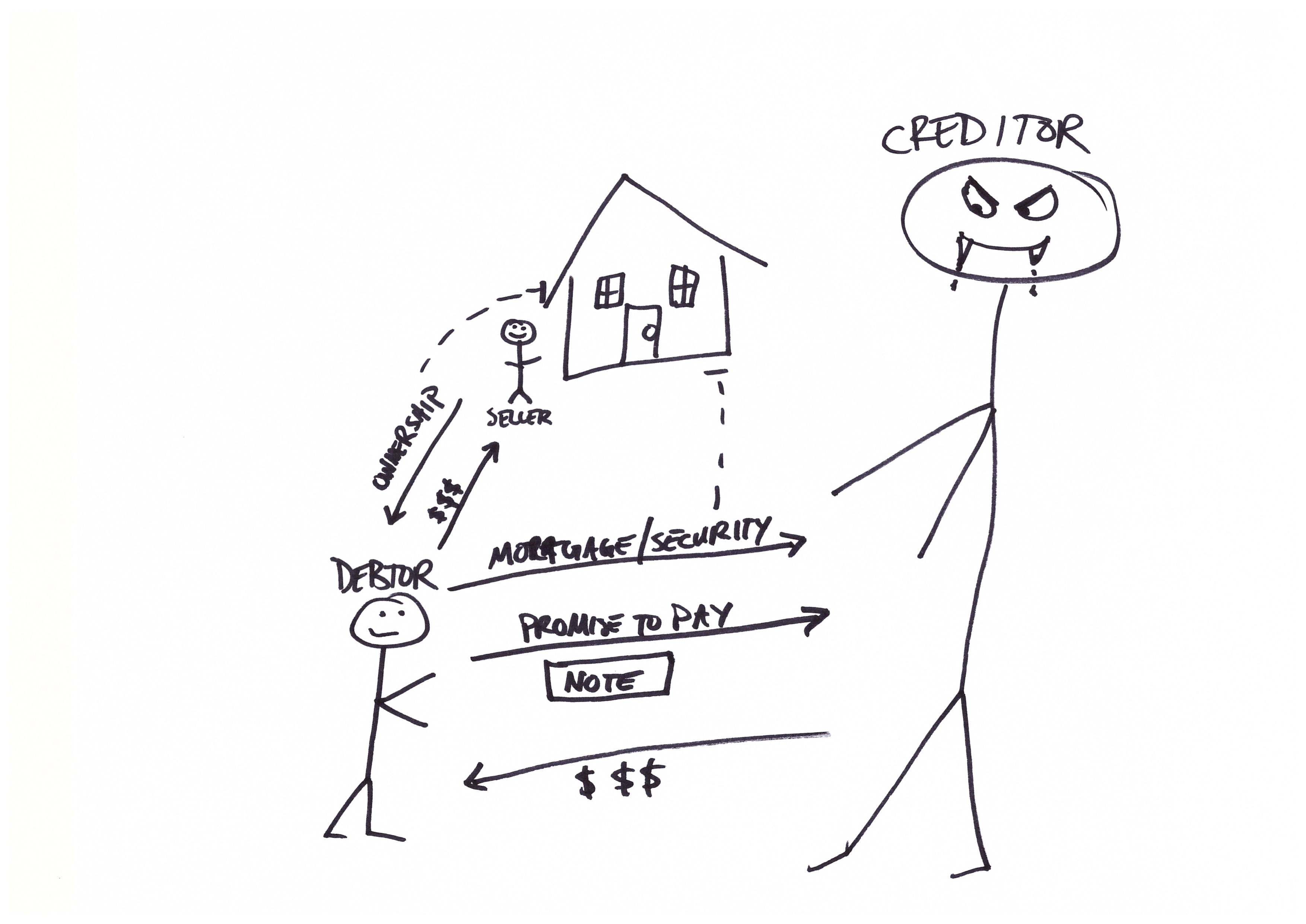

A mortgage is commonly referred to as taking out a loan “on your house”. What that turn of phrase refers to is the fact that a mortgage loans is a secured loan that uses a house as collateral (also sometimes called “security”). When you agree to have your house (or any other asset) serve as collateral for a loan, you give a creditor a “lien” on/“security interest” in your house, which basically means the right to take possession of your house if you fail to pay. This process of taking a house is called “foreclosure”. See GLOSSARY.

Technically the term “mortgage” refers not to the loan itself but to the security—the right of a creditor to foreclose upon default. So mortgage loans actually require two different sorts of documents. The note is the contract that contains the loan terms (a promissory note/contract just like any other loan). The mortgage (also sometimes called a “deed of trust”) secures the loan by giving the creditor a “security interest” in the house. This technical distinction can become important if creditors fail to get their paperwork straight. Here’s a diagram to help sort this out visually:

You can take out a mortgage on your house to pay for a bunch of different things, but the traditional and most common version of a mortgage is called a “purchase money mortgage”. As the name implies, this is a loan you take out to pay for a house, using the house you pay for as collateral. Most of this section is about purchase money mortgages, but see SECOND MORTGAGES, REVERSE MORTGAGES, AND HELOCS to learn about other types of mortgages.

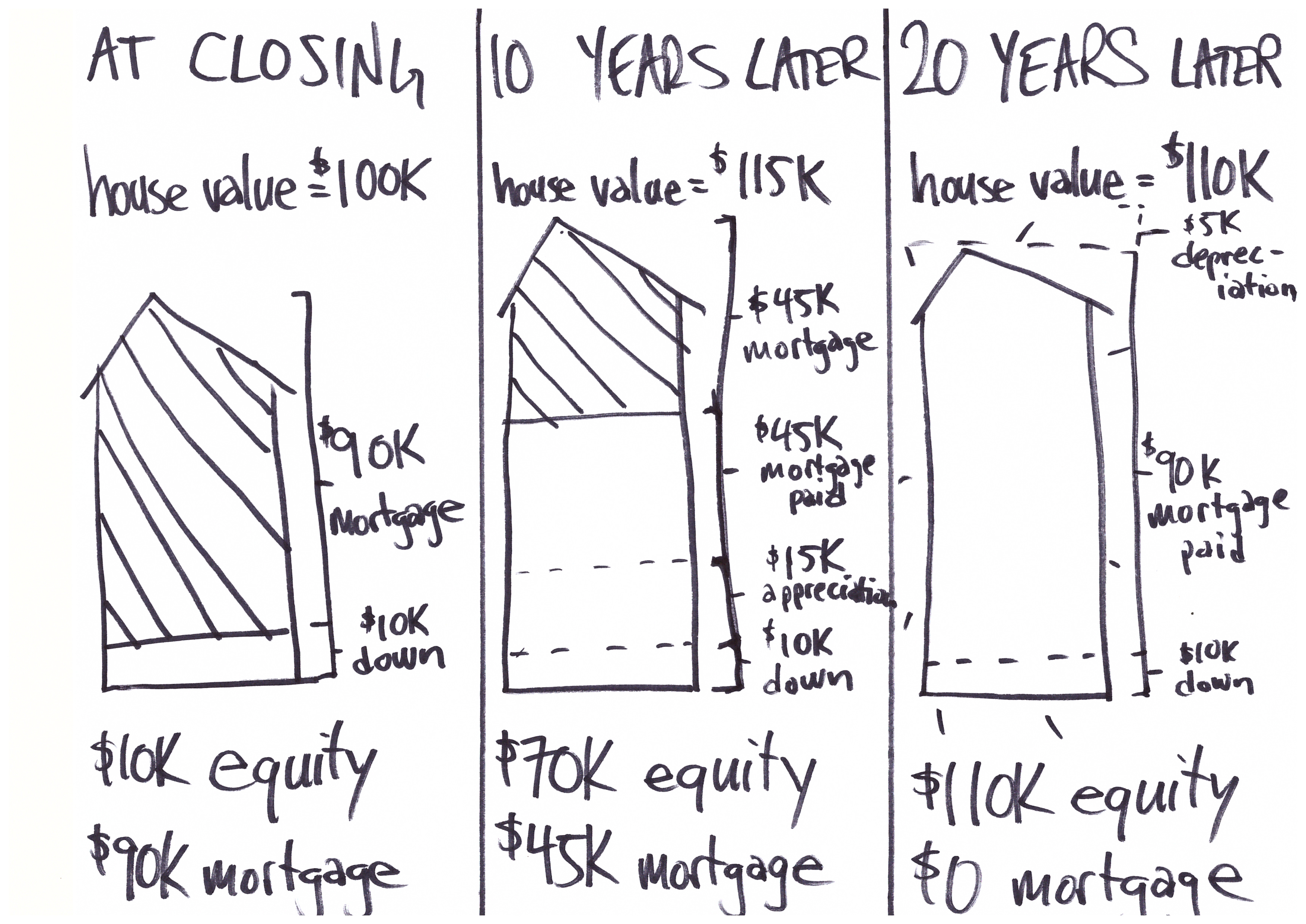

As you pay back a mortgage, you build up “equity” on your house. What is equity? It’s a word finance types use to refer to the value of the portion of your house that you own. Equity is the value of your house minus the remaining principal of your mortgage. Estimating how much equity you have in your house can be important in multiple situations when dealing with your mortgage. This diagram might be helpful in explaining what equity is and how it relates to your mortgage:

The Players

At their simplest, mortgages involve two parties: a debtor/homebuyer and a creditor/bank (in the background are government actors: regulators, guarantors, courts, etc.). The creditor gives the debtor money in exchange for a note (promise to pay) and a mortgage (security interest on the debtor’s house). Over the next 20 or so years, the debtor pays the creditor once a month.

You can break this simple arrangement into pieces. See DEBT BASICS for more on the stages of a loan. First the creditor and the debtor find each other. Then the creditor, after evaluating the debtors “creditworthiness”, originates the loan—getting the money and giving it to the debtor. Once the loan is issued, the creditor services the loan by collecting payments from the debtor, sending monthly bills, answering the debtor’s questions, etc. If something goes wrong, the creditor reverts to increasingly aggressive collection tactics and might even initiate foreclosure proceedings.

In many modern mortgages, different agents handle the different pieces of a mortgage arrangement.

A mortgage broker matches debtors with creditors.

A mortgage originator deals with the debtor until the note and mortgage are signed (they check the debtor’s credit, handle the application, etc.) and hands the money over to the debtor. Some mortgage originators—usually banks—use their own money, but some—mortgage brokers, for instance—act as middlemen between debtors and financial markets. That means that the mortgage originator is not always the same as the original lender.

A mortgage servicer deals with the debtor during repayment. Sometimes mortgage servicers also buy the loan from the original lender, but more often they work for the owner of the loan rather than owning the loan themselves. They’re contractors, in other words. A mortgage servicer is the company you deal with most directly—it sends you the bills, it collects your money, and it runs the phone lines you call when you have a question or complaint. Plus it usually handles the foreclosure proceedings if things come to that. To add to the confusion, your mortgage servicer can change over the course of repayment. Nowadays they are legally required to tell you if your servicer changes.

But where do the payments to the servicer goes if not into the servicer’s own bank account? In the modern world, the owner of the mortgage can be hard to identify. That is because mortgages—the right to receive your payments—are bought and sold (and resold and resold) frequently. Servicers are required to notify debtors when there is a new owner of their mortgage.

It’s important to note that mortgage brokers are not (necessarily) the same as real estate brokers/real estate agents/realtors (all of which refer to the same thing). Sometimes a real estate broker is also a mortgage broker, but usually real estate brokers are the individuals that help you find and purchase a house, not the individuals that set you up with financing for that house. Generally it’s good to avoid all-in-one deals or at least shop around to make sure their prices are competitive.

Side Note on Securitization

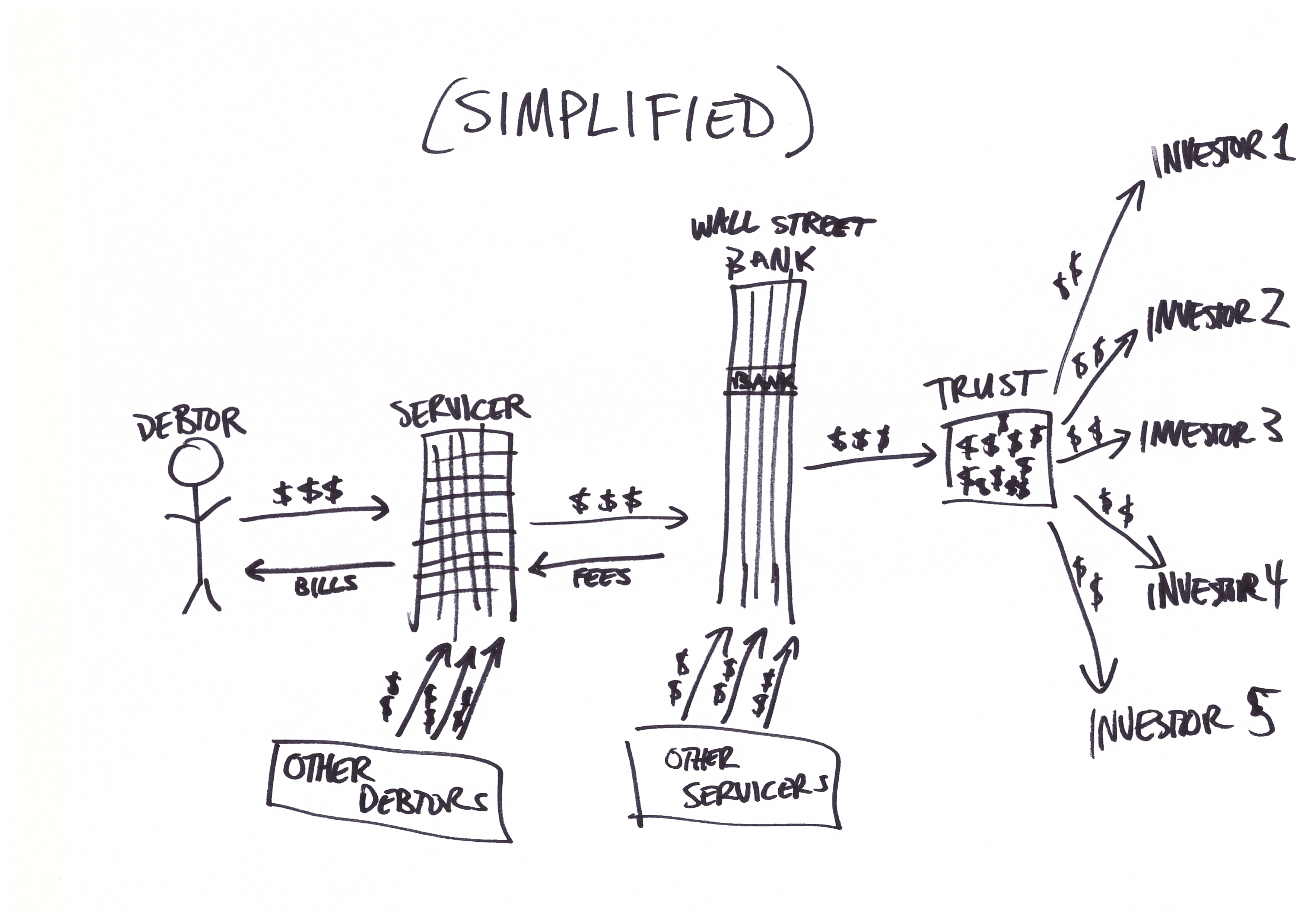

There’s added complication to many mortgages, a complication that played a major role in turning the mortgage market into a powder keg that exploded in 2007. It’s called securitization.

Securitized mortages, after they are originated, they are broken into pieces and sold. Then resold. And resold. And resold. What does it mean to say a mortgage is “broken into pieces”? Basically, whenever you pay on your mortgage, your servicer takes that money and deposits it into a trust that pools your payments on your mortgages with the payments of millions of others. This trust usually goes by the name “MERS”, and may be listed on your loan documents as the “holder”. Then investors buy (and sell and rebuy and resell) the right to portions of the money that goes into that trust.

Securitization was actually created by the federal government in the 1960s when it created the government agency “Freddie Mac” to perform an early version of it. In the 1980s, the investment bank Salomon Brothers (which—coincidentally?—collapsed during the financial crisis in 2007) created a private version of securitization. They exist side by side nowadays.

Securitization provided a way for international investors to buy a piece of the U.S. mortgage market—a piece of our debt payments. Doing so opened up the floodgates for a lot of money to slosh in. If a mortgage originator knows it can sell off a mortgage to a German investment bank or a Chinese financier as soon as it originates the mortgage, that originator will have more money to work with and will be more able to issue mortgages.

Once investors started to make a lot of money buying securitized mortgages, even more money sloshed in. Seeing the potential to make huge amounts of money reselling mortgages to international investors that knew nothing about the U.S. mortgage market, mortgage originators were practically begging Americans to take out mortgages. Mortgage brokers pushing the rest of us to buy houses increased demand for houses, which meant that prices kept going up. That meant that even if you couldn’t afford a house, it might be worth taking out debt to buy it because the value of the house would go up so much that you would earn enough money to pay off the debt. And of course that meant that international investors were even more excited to buy a piece of the mortgage market, which meant that mortgage brokers were even more excited to get the rest of us to buy houses, which meant that the prices were going up even faster which meant…that it was a self-fulfilling circle of speculation.

And then it turned into a bubble. When people are buying homes just because they think they’ll go up in value in the future (because that’s what the mortgage originators tell them because the international investors won’t make as much money otherwise), then the value of the mortgages depends on the value continuing to rise. But that can’t happen forever. And once a big portion of people weren’t able to make payments on their mortgages in 2006, people started to look around and realize that they were in a bubble. And that’s how bubbles pop.

Shopping for Mortgages

For almost everybody who takes out a mortgage, it will be the biggest purchase or financial transaction we ever enter into. Creditors also have much to gain from mortgages (an $8 trillion market!). So they have every reason to take you for as much as you have. Even though the mortgage market is regulated, not everybody follows the regulations and there are loopholes they can use to screw you over.

If only for that reason, it is important to do your due diligence. Shop around. Apply for mortgages with a few different banks/originators and compare what they give you. Ask friends and family who have experience with mortgages what their interest rates are and which creditors they have had good/bad experiences with.

If you want to talk to an expert who’s not out to screw you, you should know about housing counselors. A federal regulator, Department of Housing and Urban Development (commonly called “HUD”), certifies housing counselors. Here is HUD’s website to help you find a legitimate housing counselor in your area.

Also, after you apply for a mortgage, a lender is required to send you this guide from the CFPB on shopping for mortgages.

Whether you use a counselor or not, you should always check the terms of the mortgage you are being offered for red flags. Some things to look out for:

- High interest rates. Under federal law, the note should clearly state the interest rate as an “APR”—an annual percentage rate. If your lender presents your interest rate as a monthly rate, you should be immediately suspicious and insist on seeing the APR. Interest rates depend on your credit score, income, and the Treasury rate (the interest rate the Federal Reserve sets), so whether the interest rate you’re seeing is high is relative. That’s one reason it’s important to compare interest rates from different creditors.

- Variable interest rates/teaser rates/very low interest rates. Most mortgages charge the same interest rate over the course of a loan. But some—often called “ARMs”, meaning “adjustable rate mortgages”—charge different interest rates depending on the circumstances. ARMs are more commonly offered to less wealthy “subprime” debtors. Generally it is better not to get an ARM, since variable interest rates can mean that your payments suddenly go up beyond what you can pay for reasons totally beyond your control. Particular versions of ARMs to avoid are mortgages with “teaser rates”—very low, even 0%, interest rates for a limited period of time. Mortgages with teaser rates tend to actually be more expensive over time and may suddenly become very expensive when the interest rates pop up after the teaser period.

- Hidden fees. Creditors love to charge fees for everything they can get away with. Some of these fees are unavoidable in today’s market, but you should be alert to any fees in the mortgage contract and check with your housing counselor about them. Particular fees to be wary of are prepayment penalties, which charge you a lot of money if you pay too much on your mortgage too early; late fees, which are unavoidable but can be really steep or punitive and you can sometimes negotiate down.

- Low payments. Low payments aren’t bad in themselves, but they can indicate that your loan will be more expensive in the long term. Check out DEBT BASICS to see how this works.

- Extra insurance. You have to buy property insurance, and, if you put down less than 20% up front, you have to buy credit insurance. However, you don’t have to buy either of those things from the company your mortgage originator points you to. If they offer you other types of insurance, it’s generally better to ask yourself if you really need it, shop around for prices, and/or ask a housing counselor about it.

- Anything that sounds too good to be true. Don’t let them talk you into things that sound like you’re getting something for nothing. Be wary and ask around.

A mortgage originator is legally required to provide you with a Closing Disclosure at least three days before you close the deal that contains information about the cost of the loan. It should help you determine whether any of these red flags are present. If they are, you should ask your originator what’s up and, if they persist, refuse to take out the loan. Here is more information on the Closing Disclosure.

Do not agree to a mortgage that has:

- Interest-only payments. This will blow up in your face unless you’ve carefully planned your finances and calculated payments over time.

- Negative amortization. That means your payments don’t even cover interest. If you can’t cover interest, you shouldn’t be taking out the loan.

- Balloon payment. That’s small payments early on and then one big payment at the end. Again, it will blow up in your face unless you’ve really plotted it out

Getting Your Documents Together

As with any debt, it’s crucial to get and save all your documentation. That includes taking dated notes every time you talk with a servicer or any other agent. Store them all in a safe place. Don’t throw them out unless you’ve paid off your mortgage (and even then, it's not a terrible idea to keep them).

If you don’t have your loan documentation, you can request it from your servicer (you can also request other information). Servicers are required to respond to requests for information promptly: acknowledging your request within 5 business days and responding within 30 business days (unless they inform you that they need an extension of 15 business days).

Some important documents to have (you should keep originals wherever possible):

- The promissory note. This should be 4 to 5 pages, and will have all of the terms of the loan in it. It may also have “riders” that have additional terms.

- The mortgage/deed of trust. This gives the creditor a security interest in your house. If they don’t have this, they may be prevented from foreclosing. See FENDING OFF FORECLOSURE.

- Closing Disclosures (if from before 2013: Good Faith Estimate and HUD-1 Settlement Statement). These are summaries of the costs of the loan in the promissory note.

- Loan applications. There are usually at least two versions: one from the original application and one from closing.

- Bills and other communications from your servicer. This should include notices of transfer of ownership and/or servicing (as discussed in SERVICING SHENANIGANS).

- Notes from calls with your originator or servicer.

Servicing Shenanigans

Servicers can get up to all kinds of nonsense. Things can get especially complicated when you miss a payment, pay late, or don’t have the full payment.

If you think a servicer has applied your payments wrong, charged you too much, or otherwise screwed up (or screwed you), you have a right to dispute. Federal law requires servicers to promptly respond to and to promptly resolve disputes. Servicers much acknowledge the dispute within 5 days and respond within 30 days (with a potential 15 day extension). Your dispute does not have to take any particular form, although it must be in writing. In fact, federal law specifically requires servicers to treat any written communication that articulates an error as a dispute and to treat it accordingly.

Some common servicing shenanigans include:

- Not properly processing payments when servicers change. Many problems can occur here. You are supposed to be notified when servicers change and you have a 60-day window in which your payments must be credited even if you send them to your old servicer.

- Not crediting payments you have made. This happens most commonly when your payment has been less than the full amount due. Sometimes servicers return a partial payment. Sometimes they place it in a special “suspense account” and only apply it to your loan once there’s enough in the account to cover a full payment. Whether they have a right to do either of these things depends on your particular mortgage (look at your promissory note!), but you should always dispute when they do it.

- Crediting payments in a way that violates the loan agreement. Sometimes servicers apply payments to fees or interest when the loan agreement makes clear that they should be allocated to principal. Other shenanigans are possible. Check your promissory note and compare it to your statements from the servicer.

- Charging fees in excess of what the loan agreement allows.

- Escrow/insurance shenanigans.

Escrow, Taxes, and Insurance, Oh My!

Monthly payments on a mortgage generally include a portion to cover property taxes and insurance (usually property insurance, sometimes other types as well). Servicers are required to set up a separate escrow account in which they must put these portions of your monthly payment, so that they are clearly separated from the rest of your payment. Then they are required to use the money in that account to pay property taxes and insurance premiums when those bills come due.

Servicers are required to provide you information about your escrow account, including account statements. They are also required to refund you money if the amount in the escrow account exceeds tax and insurance bills. If that refund is large (i.e. multiple hundreds of dollars or more), likely the servicer is calculating escrow payments incorrectly and you should dispute.

On the other hand, if the escrow account does not have enough money to pay the bills, the servicer still has to cover the costs. But they can require you reimburse them through higher escrow payments in the next year.

If you do not have an escrow account, you still have to pay taxes and insurance. All mortgages require you to take out property insurance, and mortgages in which you put down less than 20% in principle generally require credit insurance as well. If you do not take out (or pay the premiums on) the insurance your mortgage requires, your servicer can take out insurance in your name and charge you for it. This is called force placed insurance. Because creditors are leeches, the insurance they buy is usually more expensive and less protective than insurance you could get on your own. If you get your own insurance, though, the servicer is required to drop the force placed insurance.

Also, if you were required to take out credit insurance you should know that once you have paid down principal (i.e. built up equity) of 20% of the original value of the house or more, you do not have to pay for credit insurance anymore. Your servicer is required to drop it.

If you think you've been discriminated against

If you think you're getting a worse deal or worse treatment or being denied a mortgage or being steered away from looking at houses in particular neighborhoods because of your race, color, national origin, religion, sex, familial status, or disability, you have recourse. The federal Fair Housing Act and the Equal Credit Opportunity Act both prohibit these types of discrimination.

Asserting your rights under these acts is easier with a lawyer. But you can do it yourself by using this HUD site for a housing discrimination complaint and/or this CFPB site for a credit discrimination complaint.

No matter how you go about complaining about discrimination, legal action is likely to come too late to actually remedy the situation. You might eventually get the lender or real estate agent in trouble and you might eventually get some money, but it's not like you will get a police officer to immediately come and force a real estate agent to stop being racist. Changing something more quickly would probably require taking direct action, with friends, family, and allies helping out: protesting and shaming the person/entity that discriminated against you.

If You're in Default or Think You Might Default

If your monthly mortgage payments have become too much or seem like they will become too much in the near future, you have a number of options to try to keep your house. The best way forward depends on the details of your situation and the type of mortgage you have.

There are basically four possible outcomes:

- If you can get back on track with mortgage payments—whether by cutting down on other expenses, modifying/renegotiating your mortgage payments, or refinancing your mortgage—you should be able to go back to roughly where you were before mortgage payments became a problem. You can keep your house. For more on this, see MODIFYING YOUR PAYMENT PLAN.

- If you are insolvent (all of your debt payments, including your mortgage, are higher than your income) or facing a lot of financial problems at once, it might make sense to declare bankruptcy. Depending on the details of your situation, doing so could allow you to keep the house and make your mortgage payments more manageable. At the least, doing so should temporarily halt foreclosure proceedings. For more on this, see BANKRUPTCY [section to be created].

- If you won’t be able to afford mortgage payments even on a modified payment plan (for example, if you got laid off and it doesn’t look like you’ll find a new source of income any time soon), you are facing foreclosure. It might make sense to sell your house to avoid foreclosure and make a little money. It might also make sense to abandon your house and your mortgage and find some place cheaper. If neither of these make sense, you can fight it out—challenging every step of the foreclosure process and physically resisting eviction if it comes to that. We will support you if it does. For more on this, see RESISTING FORECLOSURE.

- If the mortgage originator or servicer violated the law (or doesn’t have the documentation or otherwise would have legal trouble foreclosing), you might be able to avoid foreclosure or even defend against repaying some or all of the mortgage loan. For more on this, see RESISTING FORECLOSURE.

With collective action, we can create a fifth option: join with other mortgage debtors and refuse to pay until we get better terms. You may be able to do this if many of your neighbors are facing the prospect of losing their homes at the same time. Or you can join with debtors from other parts of the country who have the same mortgage lender or servicer, using our FORUMS. We’d be glad to support you when you’re ready to take action!

Obviously being faced with the prospect of losing your home is stressful as hell. Depending on how you deal with stress, you might feel like you want to avoid dealing with the situation altogether. You should resist that urge. Whatever the best option turns out to be for you, it always makes sense to make a plan and get going on it as soon as you possibly can.

The first thing you should do is set aside some time to take stock of your situation.

- Gather together your mortgage documents, information on your financial situation, and any family or friends who will be involved in figuring out what to do with you.

- Contact your servicer and ask (politely—you can get confrontational later) for your payment history and scheduled payments over the next year (and any documents you don’t have from the GETTING YOUR DOCUMENTS TOGETHER section).

- Figure out what you can afford to set aside each month for the next year or so for mortgage payments, and see how that matches against what the servicer expects you pay.

- If you know how, compare the servicer’s calculation of monthly payments with the terms in your promissory note and/or Closing Disclosure/HUD-1A form (if you took out a mortgage before 2013, it will likely be the HUD-1A).

- Ask yourself if your mortgage originator or servicer lied or misled to you about anything or otherwise engaged in shady practices that might be illegal.

After doing an initial assessment, it’s best to have a professional to work with. That could be an attorney, if you can find one you can afford who will take your case. You might start here: http://www.consumeradvocates.org/find-an-attorney. It could also be a housing counselor, some of whom specialize in foreclosure advice: https://www.hud.gov/offices/hsg/sfh/hcc/hcs.cfm.

A lawyer or housing counselor can guide you through your options. The following few sections will outline what different options look like.

Modifying Your Payment Plan

There are two different ways to modify your payment plan to get out of default (or avoid default) and remain in good standing. You should consider them in order.

But before you consider any of them, if you are in the military or are a veteran, contact a Regional Loan Center, which will help you navigate your mortgage situation.

Loan Modification Programs: HAMP and HARP

In 2009, the Federal government passed the “Making Homes Affordable” act, creating the HAMP and HARP programs. Compared to all the free money the government gave the banks that caused the financial crisis, this gesture towards the rest of us is pathetic. It’s basically just a plan to force some servicers to refinance loans in a way that keeps the loans profitable for them. Just because it’s a pittance doesn’t mean you shouldn’t take advantage of it if you’re eligible, though. It can be helpful in getting you back on track on paying the ransom to your servicer to keep your house.

If you took out your mortgage before 2009, you’re likely eligible—even if you already used the program before. Your servicer may have even notified you of your eligibility.

HAMP and HARP plans operate on a common framework. Generally you will be offered one of the following possibilities (the details of which vary depending on your situation):

- Reinstatement: this is where you pay your arrears (i.e. the amount of payments you’ve missed) and the servicer agrees to put you back in good standing moving forward so long as you pay in full and on time.

- Repayment plan: this is where a piece of your arrears is added to your monthly payments moving forward (rather than paying it back all at once) and you negotiate a monthly repayment amount that works for both you and your servicer.

- Forbearance: this is a broad term that refers to any sort of plan that lowers your payments in the short term due to some sort of hardship or emergency that you will likely find your way out of soon (rather than a permanent hardship that will make it impossible to ever pay your mortgage). Usually forbearance then turns into a repayment plan after the shorter-term hardship has ended.

- Assumption: this is when somebody else (a family member or friend) agrees to help out with your mortgage payment and co-signs your note. Assumption is risky as it can put serious strain on close relationships that you might want to preserve more than you want to save your house.

- Short sale: this is when you sell your house through a realtor to avoid going through foreclosure when you know you won’t be able to pay your loan even with a modified payment plan. Generally if this is done under HAMP or HARP the creditor will be required to accept the sale as payment in full even if the house doesn’t sell for enough to cover the full amount outstanding on your mortgage (this is called “waiving the deficiency”).

- Mortgage release/deed in lieu: this is a last resort. It is when you hand over the property to the creditor rather than going through foreclosure. You should get up to three months to remain in your house. Under HAMP/HARP, creditors generally will pay for your moving expenses up to $3,000 if you do this. A deed in lieu is a bad idea if you have significant equity in your house.

As you can see, these plans are mostly oriented towards helping you deal with a temporary setback to get back to paying your mortgage as you were or to help you get out of your mortgage (and your house) without having to go through foreclosure. If you got screwed over in the mortgage crisis and the Great Recession it caused in a way that leaves you in long-term financial trouble, the “recovery” programs the creditor-controlled government put together aren’t for you.

The way HAMP and HARP programs work are complicated and depend on many details about your mortgage loan that you likely know nothing about. However, your mortgage servicer is generally obligated to review your loan for eligibility for these programs and to provide you the best offer they can. As we know, just because a servicer is legally required to do something does not mean they will do it. That is why it is useful to have a housing counselor and/or attorney in your corner to help you navigate these programs (https://www.hud.gov/offices/hsg/sfh/hcc/hcs.cfm).

If you don’t have access to a housing counselor or want to dig into the details on your own, check out the National Consumer Law Center’s excellent book: Guide to Surviving Debt.

For any of these programs, you will be evaluated on your “NPV” (“net present value”—basically whether it will be profitable for a servicer to help you refinance your loan). Here is the site created by the federal government to help you calculate your NPV.

If you have a private loan (not held by Fannie Mae or Freddie Mac or the VA or the RHS), you can get help at HUD’s website.

If you have a loan with Fannie or Freddie (your servicer will know and it should say on your bills), check out Freddie Mac’s site on it or Fannie Mae’s.

If you are a veteran or a military member, you’ve got the hookup

Why wouldn’t they just coordinate and have the same site? Because creditors run the world and they don’t really care about the rest of us unless it makes them money.

Workouts

If you don’t quality for a HAMP/HARP modification, you might still be able to negotiate a way to stay in your house while making payments that don’t ruin you. If these negotiations are successful, the result is generally referred to as a “workout”.

If your loan is held by the FHA, the VA, or RHS (Rural Housing Service), you are likely eligible for workout options similar to the HAMP/HARP options discussed in the previous subsection. Talk to a housing counselor and your servicer about these options.

If your loan is held by a private creditor, there’s no special process and no requirements for them to listen to you. It’s a matter of bargaining with the creditor (usually through your servicer). Somebody at your servicer’s office might be sympathetic if you’re facing hardship, but for them the bottom line will always be whether it’s more profitable to agree to a workout that would keep you paying or to foreclose on your house when you can’t pay. Thus, if you’re at a stage where you think you’ll be able to pay on the loan and keep your house as long as you work out a modification in your payments but not otherwise, you should emphasize that you want to pay and you can pay—just not under the present circumstances. Make it clear that agreeing to a workout is best for their bottom line.

Negotiating a workout is much easier to do with a housing counselor or attorney on your team . As well, you may wish to draw from a more detailed guidebook like NCLC’s Guide to Surviving Debt (https://library.nclc.org/node/184511).

If you want to negotiate a workout, you should:

- Start preparing ASAP. The longer you put off dealing with a debt you cannot pay, the less likely you are to successfully negotiate and the more likely you are to start negotiating too late in the foreclosure process.

- Determine if you have any defenses to repayment (if the creditor or servicer misled you, doesn’t have relevant documentation, or otherwise violated the law). If you do, you should consider how to get out of paying rather than negotiating a new payment plan. See RESISTING FORECLOSURE.

- Get your documents together (see GETTING YOUR DOCUMENTS TOGETHER) and assess your financial situation. Your documents should allow you to figure out how much you have in arrears and what your mortgage payments will be over the next year under your current plan. Put together a monthly budget for the next year summarizing all your income and expenses (including this mortgage). Play with it to see what happens when you cut back on this or that expense or find this or that source of income. This will help you figure out what you can afford to pay on your mortgage. Here is a useful guide for making a budget spreadsheet: http://www.wikihow.com/Create-a-Budget-Spreadsheet. Here is a basic guide on budgets from the FTC: https://www.consumer.gov/sites/www.consumer.gov/files/pdf-1020-make-budget-worksheet_form.pdf.

- Figure out how much your property is worth. One of the best ways to do this is to see what similar homes in your area have sold for recently (check out https://www.zillow.com/, for example).

- Determine what you need in a workout. Do you need to lower your monthly payments for the long term or do you just need temporary relief? Do you need a way to get current by paying off your arrears? Can you pay any of your arrears in lump sum or will you need to pay them off as part of your monthly payments? Do you need somebody else to help with monthly payments? Once you answer these and other questions that relate to your situation (a housing counselor and/or a more detailed guide will help you work through all the different issues), you can come up with a proposed workout plan.

- Write down what your bottom lines are, a proposed workout plan, and, if you want, a “hardship” letter describing how you got into your financial circumstances in a way that makes the servicer sees you as a human being rather than just another body to pump money out of.

- Contact your servicer, propose the plan, and take notes. Bargain with them and see how far you can get.

- If bargaining doesn’t go well, you can try to appeal to a supervisor. You can also see if you can get another mortgage lender to refinance your house with more affordable payments. But that will only work if the value of the house is more than the amount you owe on your mortgage (since the new loan from the new lender will have to cover the amount you owe and it will be based on the value of the house).

If you do not think you will be able to afford your mortgage—whether that’s because your servicer isn’t negotiating or you just know based on your financial situation—you can also avoid foreclosure by getting rid of your home without foreclosure.

A short sale is where you get a service to agree to let you sell your home using a realtor and to not collect on the amount you still owe on your debt even after you’ve sold your house.

A deed in lieu is where you transfer the house to the servicer/creditor without a foreclosure process in exchange for them not collecting on any amount you still owe on the loan. They might even pay your moving expenses.

Always always always get any arrangement you make in writing with the creditor’s signature.

Resisting Foreclosure

Foreclosure is the process by which a mortgage lender uses the legal system to put a delinquent debtor’s house up for auction. The lender then uses the money they make to cover as much of the remaining amount left to be paid on the mortgage as it can. In most states, if the amount the house is sold for does not cover the amount left on the mortgage, the creditor can go after you for the “deficiency” (see the chart of state laws here: http://www.nolo.com/legal-encyclopedia/50-state-chart-key-aspects-state-foreclosure-law.html). On the other hand, if the creditor sells the house for more than what is left on the loan, you are supposed to get a check for that amount.

You are supposed to get a notice from your servicer if a creditor is going to foreclose on your house. In fact, you should get at least two notices: one to let you know about your default and one called a “notice of acceleration”. Creditors end out notices of acceleration when the loan has been in default long enough (how long is enough depends on the loan terms in your note) that the creditor is accelerating the loan—making it all due at once. This is the last step before foreclosure.

Many states do not require servicers to take you to court to foreclose, but some do. You should receive notice about court proceedings. If you do not receive notice of court proceedings but you received a notice of acceleration, foreclosure may happen without giving you a chance to defend yourself. In that case, if you were going to defend yourself legally you would have to sue the servicer/creditor. This is much easier to do with a lawyer (http://www.consumeradvocates.org/find-an-attorney).

If you are facing foreclosure, you have five basic options:

- Defend. If the servicer or creditor has violated a law, you can use that as a defense to repayment of some or all of the loan.

- Pay. If you can put together the money to pay the arrears, you can likely pull the loan out of foreclosure. If you can find the money to pay the entire remaining principal, you can end foreclosure proceedings and all relations with your creditor (unless you suddenly became rich you would need to take out a different mortgage to do this, thus refinancing your loan).

- Delay. By insisting that the servicer follow procedures and asking for more time where possible, you can drag out the process. This is best combined with other options.

- Resist. You can make things as hard as possible for the servicer, wearing down their will to come after you.

- Walk away. If you know you don’t have the money and you’re prepared to leave your house behind, you have no reason to keep dealing with the servicer. They may still come after you for some money, but they might not.

(Bankruptcy is another option, but that is for another section: BANKRUPTCY [site in progess]).

Defenses Against Repayment

It is difficult to assert defenses against repaying your loan without the help of an attorney or at least a housing counselor. But even if you cannot find a professional who can help you, it is worth raising defenses as best you can.

Some defenses come from special protections for loans insured by the FHA, the VA, or RHS. If your loans fit these categories (your servicer will know and your loan documents should indicate), you should definitely contact a housing counselor. If you are a veteran, you have the additional resource of a Regional Loan Center.

No matter what type of mortgage you have, you have defenses against repayment if the originator or servicer of the loan violated certain laws. Generally these laws are concerned with fraud/misrepresentation. So, if you didn’t sign the promissory note for your mortgage or if the originator lied to you to get you to sign or a servicer charged you the wrong amount or something along those lines, you probably have at least a partial defense. There may also be other violations that are hard to spot without some legal experience.

If you think you have a defense and you don’t have a lawyer helping you, you have two basic options.

First, if your lender sues you in order to foreclose, you can respond to the suit by asserting your defense in writing, in person at the hearing, or both.

Second, if your lender does not sue you (and you live in a non-judicial foreclosure state), you probably have to sue the lender.

Paying to Get Out of Foreclosure

There are four chances you have to pay to stop foreclosure.

First, if you have enough money to pay the arrears (not the whole loan—just the unpaid bills) before the foreclosure sale takes place, you can reinstate the loan. Many states require creditors to reinstate the loan if you pay arrears. Even in those that do not, courts often put pressure on creditors to do so. And creditors/servicers often would prefer to collect arrears and keep taking your money than go through the expense of foreclosure. If you have the money and want to pay it, you should immediately tell the servicer in writing that you wish to reinstate the loan.

Second, if you have enough money to pay the deficiency (i.e. the entire amount of the loan you haven’t paid down yet) before the foreclosure sale, you can redeem the loan. You have this right in every state. Even if you don’t have the money yourself, you can redeem a loan through refinancing. Doing so requires finding another creditor willing to give you a loan for the remaining principal on your existing mortgage (usually this is a mortgage loan that replaces your existing mortgage). Generally, it is only worth refinancing if the terms on the new loan are as good or better as the terms on the old loan.

Third, when the foreclosure sale takes place, you might be able to buy your house back. Maybe even for less money than you owe on the loan. Foreclosure sales are auctions that almost nobody attends. Likely it would just be you and a representative from your creditor. You might be able to make a bid on your house that is less than the market would pay for it. Obviously this is a risky move, since you might lose the bid and with it your house. And even if you do win the bid, if the amount you pay is less than the amount left on the loan you might have to pay the difference if you live in a “deficiency” state (see this chart: http://www.nolo.com/legal-encyclopedia/50-state-chart-key-aspects-state-foreclosure-law.html).

Fourth, if you have enough money to pay down the amount left on your loan—whether out of pocket or from a loan—after the foreclosure sale, in some states you can still redeem the loan. This chart shows you if yours is one of those states: http://www.nolo.com/legal-encyclopedia/50-state-chart-key-aspects-state-foreclosure-law.html.

Delaying Foreclosure

As with asserting defenses, delaying foreclosure is much easier if you have an attorney in your corner. The best techniques for delaying involve arguing over procedural technicalities. But other techniques include asking the court for more time (nice and direct) or asking to negotiate with the servicer even if you don’t intend on paying.

You can also request a mediation proceeding with your servicer, which some states provide for (see http://www.nolo.com/legal-encyclopedia/50-state-chart-key-aspects-state-foreclosure-law.html).

The more time you can delay, the more time you have to put together money to reinstate or redeem the loan, to develop defenses, and put together your resistance strategy.

Resisting Foreclosure

If you can’t pay and don’t have any defenses, you can still resist foreclosure. It is much easier to do so if you have others—family, friends, neighbors, other Debt Collective members—to help you.

The most direct form of resistance is to refuse to leave your home once the servicer gets the police to come evict you. When we join together and put our bodies in the way of the forces of eviction, we can stop it. It has been done. Occupy Our Homes stopped multiple foreclosures through eviction blockades. As have organizations like Causa Justa/Just Cause and City Life/Vida Urban. In Spain, a group called PAH has not only stopped thousands of evictions through direct action, they built the power to take on landlords and mortgage lenders at the municipal level. A former PAH member, Ada Colau, is now mayor of Barcelona.

You have a right to a home. Don’t let the banks take it from you. Reach out in the FORUMS for solidarity.

Walking Away

If you owe more on your mortgage than your house is worth, it is not worth revitalizing the mortgage unless you have absolutely nowhere else to go. You are allowed to walk away from your mortgage. In some states you will be held liable for the deficiency, but not all (see http://www.nolo.com/legal-encyclopedia/50-state-chart-key-aspects-state-foreclosure-law.html).

Second Mortgages, Reverse Mortgages, HELOCS

The most common type of mortgage is the purchase money mortgage—a mortgage used to buy the house that serves as the security for the debt. The previous sections have been focused on this type. But there are other loans you can take out that use your house as a security.

Second Mortgages

As the name suggests, a second mortgage is a loan taken out using your house as security when you already have a mortgage on your house. In a second mortgage, you borrow against the equity you have in your house (i.e. the portion of the house that you own outright—see MORTGAGE BASICS. Second mortgages can be taken out to pay for anything—commonly they are used to pay for house repairs or renovations.

Second mortgages are junior liens that are subordinated to purchase money mortgages. That means that if you go into default on your mortgages and both mortgage lenders initiate foreclosure, the second mortgage lender has to get in line behind the first mortgage lender. Because they have lower priority, second mortgages generally come with higher interest rates.

Just because second mortgages have lower priority as securities does not mean you should treat them as any less of a big deal that purchase money mortgages. Second mortgage lenders do have the power to foreclose and they can be more predatory than other mortgage lenders

Home Equity Loans and HELOCs

Like second mortgages, home equity loans and HELOCs (home equity lines of credit) allow you to borrow money against the equity of your house. In fact, most second mortgages are home equity loans or HELOCs. But you can also take out a home equity loan or HELOC even if you don’t have another loan on your house—if, for example, you’ve already paid off your purchase money loan.

With a home equity loan, a lender gives you a lump sum in exchange for a promise to repay, usually in monthly installments, and a security interest in your house (it could be a junior lien or a senior lien). A HELOC operates more like a credit card with a lower interest rate. Rather than give you a lump sum up front, a lender allows you borrow periodically up to a credit limit (usually close to the amount of equity you have in your house). You only have to pay back what you’ve already borrower—plus interest and fees—and you can keep borrowing more so long as you don’t exceed your limit.

Lenders can make a lot of money off of you with these types of loans, especially with HELOCs. It can be tempting to think that using your house as a credit card is a cheap way to borrow money you need, but remember that the stakes are high. And lenders love to push you to borrow as much as possible with tricky fees and billing practices (see CREDIT CARDS). With a credit card, if you stop paying you’ll get collectors bugging you, dinging your credit, and maybe even suing you if you have a high enough debt. If you stop paying a HELOC you get all of these things plus you risk losing your house.

Reverse Mortgages

Reverse mortgages are like running a tab on your home. They allow you to borrow money against the equity on your house—like home equity loans and HELOCs—but they don’t bill you every month. Instead, they keep track of the amount you’ve used plus interest. You can pay it back at a later date if you want, or you can just keep the debt until you die. Then the bill comes with the house—whoever gets it after you die is on the hook.

Reverse mortgages are commonly marketed to older folks. This is because older folks are more likely to have a lot of equity in their houses, not that much income (and so a need for extra money), and are closer to death.

Reverse mortgage lenders can be very predatory—they make their loans sound like an amazing deal while deemphasizing the fact that the loan will have to be paid eventually and, if not, they can take your house. It’s generally a good idea to check with a housing counselor or financial adviser before taking one out.

If you have a reverse mortgage, you should make sure you know how much you owe on it and make sure your heirs know about it. If you’d rather not pass the debt onto your heirs, you should make a plan as soon as possible to figure out how to pay it off or otherwise get out of it.