Introduction

Creditors have created stereotype of folks who struggle to pay credit card debt. They say these folks are “irresponsible” and “spending beyond their means”. It’s a lie. Most people get into credit card debt just trying to get by. The rich have stopped sharing the wealth: they cut our wages, they cut our public services, and they charge more for essentials like healthcare and housing. Credit card debt is just a way for them to take even more money from us when we can’t pay for our medical bills, car repairs, or groceries.

And creditors use credit cards to make a lot of money off of our hardship. Credit card departments are often the most profitable departments in banks.

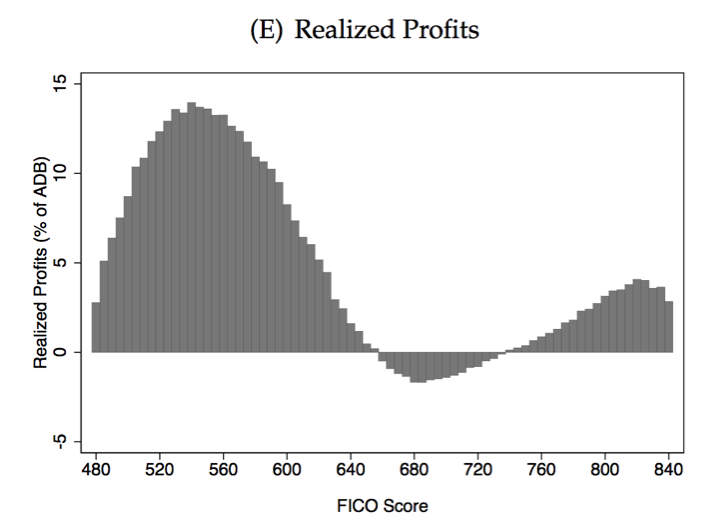

How are credit cards so profitable? See for yourself:

(source: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2330942)

As you can see, credit card issuers make most of their profit on credit cards from folks with credit scores below 600. In other words, they make their money from folks who are struggling.

How? They use sophisticated statistical analyses of credit scores to find people who are unlikely to pay off their full balances each month and to push other people to pay less than the full balance. Then they charge these credit card users high interest rates and encourage them to pay back that money as slowly as possible. That way, banks make a huge amount of money on interest. If a bank can get you to only pay interest, then you will keep paying indefinitely, since you never lessen the principal (see INTRODUCTION TO DEBT). This is called “revolving” a debt.

Oh, and then banks figured out that they could hide additional fees in the fine print. Pure profit!

Credit Cards vs. Debit Cards vs. Prepaid Cards

Debit cards, prepaid cards, and credit cards all look the same. So it’s easy to make the mistake that they work the same way. But they don’t. Creditors want to confuse you, because they make huge amounts of money by getting you to use credit cards in a way that puts you into debt. That’s why credit cards come with rewards, for example.

You can only have a debit card from a bank where you have an account (they also serve as ATM cards). And you have to have money in the account. That’s because when you pay with a debit card, the money comes from your bank account. Your bank account is “debited” (i.e. the amount you paid is taken out) and sent over to the bank of the business you paid with your debit card.

If you don’t have money in your account when you try to pay with a debit card, your card is either declined or the bank that has your account fronts the money in an “overdraft”. Generally, banks charge fees for overdrafts, and sometimes interest too. So it’s better to only use a debt card if you know you have money in your account.

But, as long as you keep money in your account, a debit card is the safest and easiest way to pay.

Prepaid cards and payroll cards work like debit cards in that you have to have the money before you spend it. But you don’t have to have an account with a bank. Instead, you pay or your employer pays the card issuer in advance (you “prepay”) and the card issuer loads up the card with the money you put on it. Usually prepaid card issuers charge fees for using the card, so it’s usually more expensive than a debit card plus a bank account.

When you pay with a credit card, on the other hand, technically the credit card issuer pays the business you used the card at directly. It fronts you the money and then has you pay it back later. You do not need to have an account with bank that issues your credit card, nor do you have to pay it money in advance. This is because every time you use a credit card, you are technically going into debt to your issuer.

As long as you pay the debt back when your next monthly bill comes due, credit card issuers do not charge you any interest. This is one of the advantages of credit cards: it’s an interest-free short-term loan. But if you pay less than the full amount on your monthly bill, the balance you don’t pay immediately become a high-interest loan.

The way creditors make so much money on credit cards is by encouraging you to pay less than the full monthly balance. Then they can charge you high interest and tack on fees as well. They actually hate people that pay off their balances every month. They call them “deadbeats”.

How Credit Cards Work and How They Get You

When a bank or other creditor gives you a credit card (after you’ve signed a contract), they are telling you they will pay for any purchase you make with the card. But not out of the goodness of their hearts. They have conditions:

- They will only pay for purchases up to a certain amount each month. They call this the credit limit. Generally your credit limit is higher if you have a high credit score and high income. But creditors play with it all the time, since they want you to go over your credit limit so they can charge you fees (although not so far over that you can’t pay them!).

- They will bill you every month.

IF YOU CAN AFFORD THE FULL BALANCE, YOU SHOULD ALWAYS PAY IT AND PAY IT ON TIME.

- If you don’t pay the full amount, they will start to charge you interest on the amount you don’t pay. They want you to pay interest, because that’s how they make money. That’s why they put a “minimum payment” on your bill. They want you to pay the minimum payment so they can charge you interest on the rest. Ignore the minimum payment. Think about how much you can pay and pay it.

- If you pay late, they will charge a late fee.

- They might charge you other fees. Look carefully on your bill. If you find a charge you don’t recognize, you might be able to contest it.

- They can cancel your card at any time. So can you (although this won’t remove your balance).

Choosing Credit Cards

You probably don’t need a credit card. Nowadays anything you can pay for with a credit card you can also pay for with a debit card. In fact, in most countries almost everybody uses debit cards.

The main advantage of a debit card is that you pay for it in advance, so credit card issuers can’t manipulate you into going into debt that you can’t pay off.

There are some advantages to a credit card over a debit card.

- If you need to improve your credit score, paying for things on a credit card and regularly paying the monthly balance can help you do so.

- It’s easier to dispute a charge on a credit card. Check out the DISPUTING A CHARGE section

- Many credit cards have rewards programs. These programs tend to be more lucrative if you have a high credit score, though.

- You can use them to borrow money if you really need it and can’t get the money anywhere else. But credit cards have high interest rates, especially if you have a low credit score. So you should only use them to borrow if you have ruled out other options. Here is a good source on shopping for small-dollar loans: https://www.nerdwallet.com/blog/loans/small-dollar-loans/

When you’re considering getting a credit card, remember:

- Don’t just go for the credit card with the rewards that sound best. Credit card issuers want you to pay attention to the flashy rewards and ignore the fine print.

- If a credit card says something that sounds too good to be true, it probably is. If it looks like a really low interest rate, check and see if it changes over time or if there are hidden fees. If it says there is none of a certain type of fee, check and see what other types of fees they have.

- The best credit cards are reserved for the rich.

With that in mind, here are a couple resources that might help you comparison shop and navigate the fine print: https://www.nerdwallet.com/blog/credit-cards/how-to-pick-the-best-credit-card-for-you-4-easy-steps/ https://wallethub.com/credit-cards/ http://cardtrak.com/popular-us-credit-cards https://www.creditkarma.com/credit-cards

Disputing a Charge on a Credit Card

If there’s a charge on your credit card bill that you don’t recognize or that you think is incorrect, you have a right to dispute it. All credit card issuers have relatively easy to navigate dispute processes. And, perhaps surprisingly, credit card issuers will often refund your money. They will do this because they usually don’t have to pay for it: they can pass the charge back to the business that overcharged you or the person who stole your card.

Most credit card issuers now have an online tool to dispute a charge. If you cannot find it, call your credit card issuer and ask them how to dispute.

What to do if a Credit Card Issuer Screwed You Over

The first thing to do is to complain directly to the credit card company. They’d usually rather keep you as a customer, so you may be able to get them to remove a hidden fee or knock down the interest rate if you tell them you’re going to stop doing business with them otherwise.

If that doesn’t work, you might be able to sue a credit card company for failing to disclose information, discriminating, or something else. Credit regulations aren’t great, but it’s possible. The best thing to do is contact a consumer lawyer in your area.

You can also complain to the CFPB (https://www.consumerfinance.gov/complaint/#credit-card) and the FTC (https://www.ftccomplaintassistant.gov/#&panel1-1). They will not represent you directly, but if they get other similar complaints they may go after the creditor.

What to do if You Can’t Afford the Payments

If you fall behind on payments and find yourself unable to pay (or you’re just sick of paying those warts on humanity), you have a few options.

If you stop paying altogether:

- You will likely get increasingly aggressive letters, calls, and emails from your credit card issuer

- They will ding your credit report quickly and repeatedly. If you monitor your credit score (see the CREDIT REPORTS section for more), you can see how much this is damaging your credit. Rather than panicking, know what you’re facing. Lower credit isn’t the end of the world.

- Unless you owe a lot of debt (something approaching ten thousands dollars or more), they likely won’t sue you. But they do have the right to sue you. Make sure to keep a file with all your documents, including your promissory note (see INTRODUCTION TO DEBT for more on promissory notes) in case you have to defend yourself.

- Once you haven’t paid for 90 days, the credit card issuer is likely to sell your debt to a debt collector or to hire a debt collector. For more on how to deal with debt collectors see DEBT COLLECTORS.

- After 180 days, the credit card issuer has to “charge off” your debt, which means they have to mark it on their books as a loss. They might still come after you for the debt, but more likely they’ll sell it to a debt collector. They still have the right to collect on it until the statute of limitations runs out, but they’ll surely be more willing to negotiate.

You can bargain for lower payments. Credit card issuers would rather have you pay something than nothing. Tips for bargaining:

- The credit card issuer will probably try to scare you into paying and tell you that they don’t bargain. Remain calm and be insistent. They’d rather scare you into paying the full amount than bargain, but they’d also rather bargain than have to charge off your debt.

- You’re more likely to get them to bargain and to get a better deal if you convince them you really aren’t going to pay unless they bring the cost down.

- Get any deal in writing, and make sure the deal takes care of the whole debt. That way they can’t go back on the deal later.

Credit card debts have high interest rates. You might be better off getting a loan from somewhere else with a lower interest rate (a bank, for example, or an online lender, or a line of credit on your house, or even a better credit card) and use that to pay off the principal of the credit card debt. If you do that, make sure to close your credit card account afterwards.

If they sue you, you can defend yourself. Although it’s always better to have a lawyer. Check out the DEBT COLLECTORS page for more information.

Prepaid Cards and Payroll Cards

Generally having an account at a credit union or a local bank (which would come with debit cards) is better than having a prepaid card. But prepaid cards can be a second-best option.

Prepaid cards tend to come with all kinds of fees. They charge you money to get access to your money. Before you get one, you should check the terms and conditions and think about how much it will cost to have the card and to use it. The CFPB has a helpful list of common fees: https://www.consumerfinance.gov/askcfpb/2053/what-types-fees-do-prepaid-cards-typically-charge.html

Payroll cards are a type of prepaid card that employers use to pay employees. Your employer cannot force you to accept payments on a payroll card. Generally, it is better to be paid via direct deposit in an account at a credit union or a local bank than via a credit card.